„I knew from my own experience about the mysterious attraction of the ‘royal game’, the only one of all games devised by man that sovereignly eludes any tyranny of chance and assigns its palms of victory solely to the mind, or rather to a certain form of mental talent.“

Stefan Zweig, Chess: A Novel

Source: Reuters Eikon, Incrementum AG

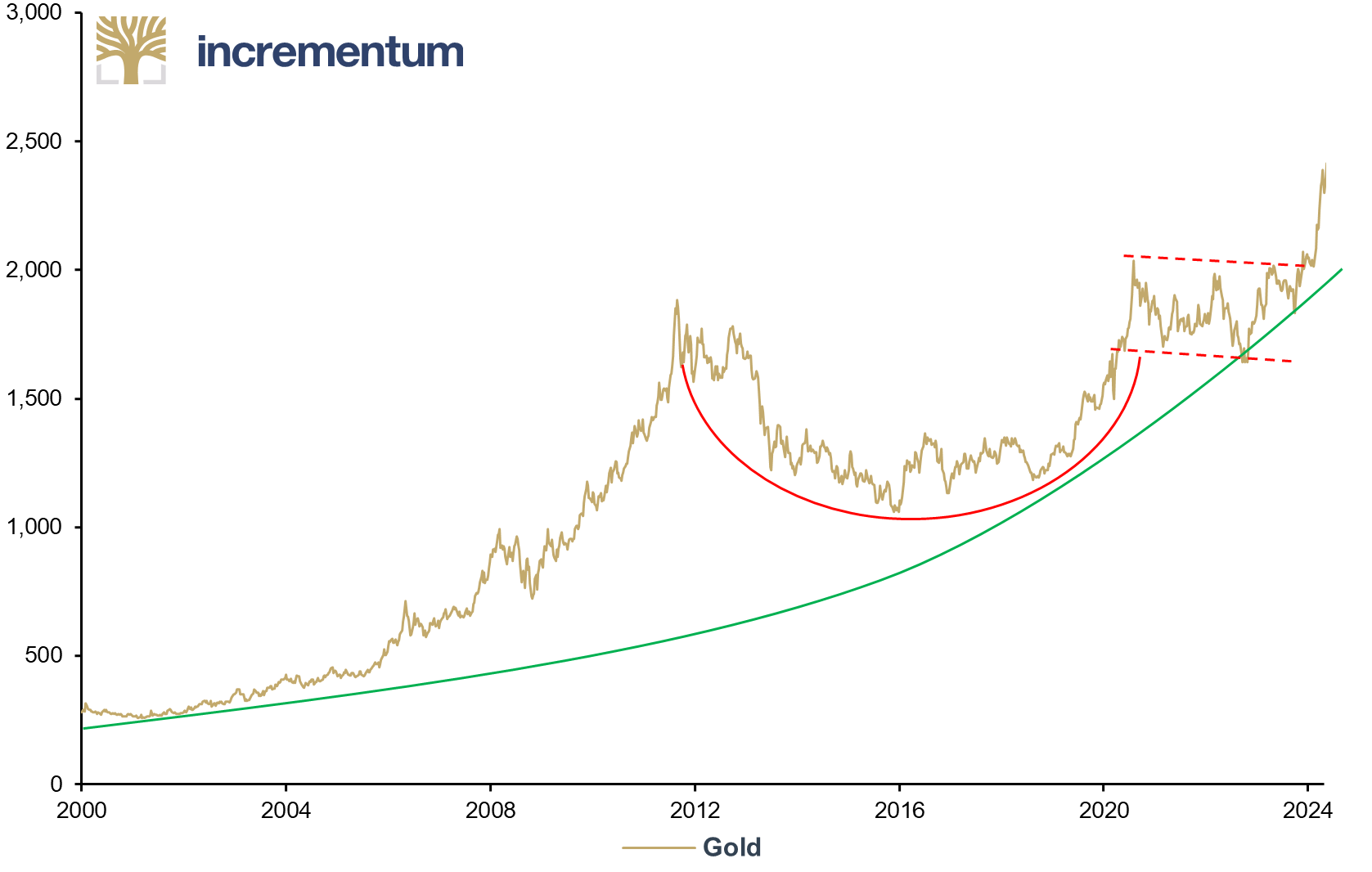

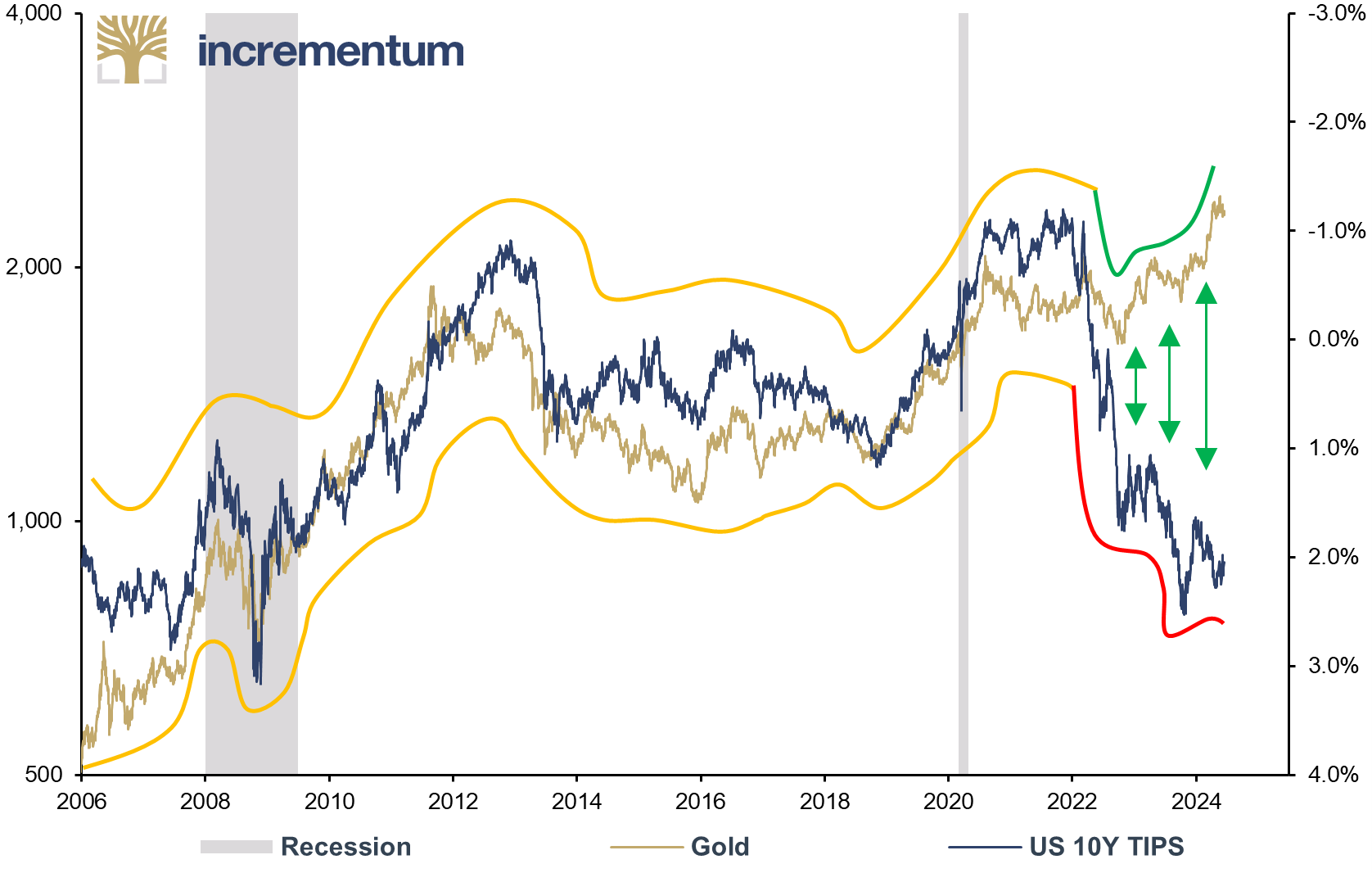

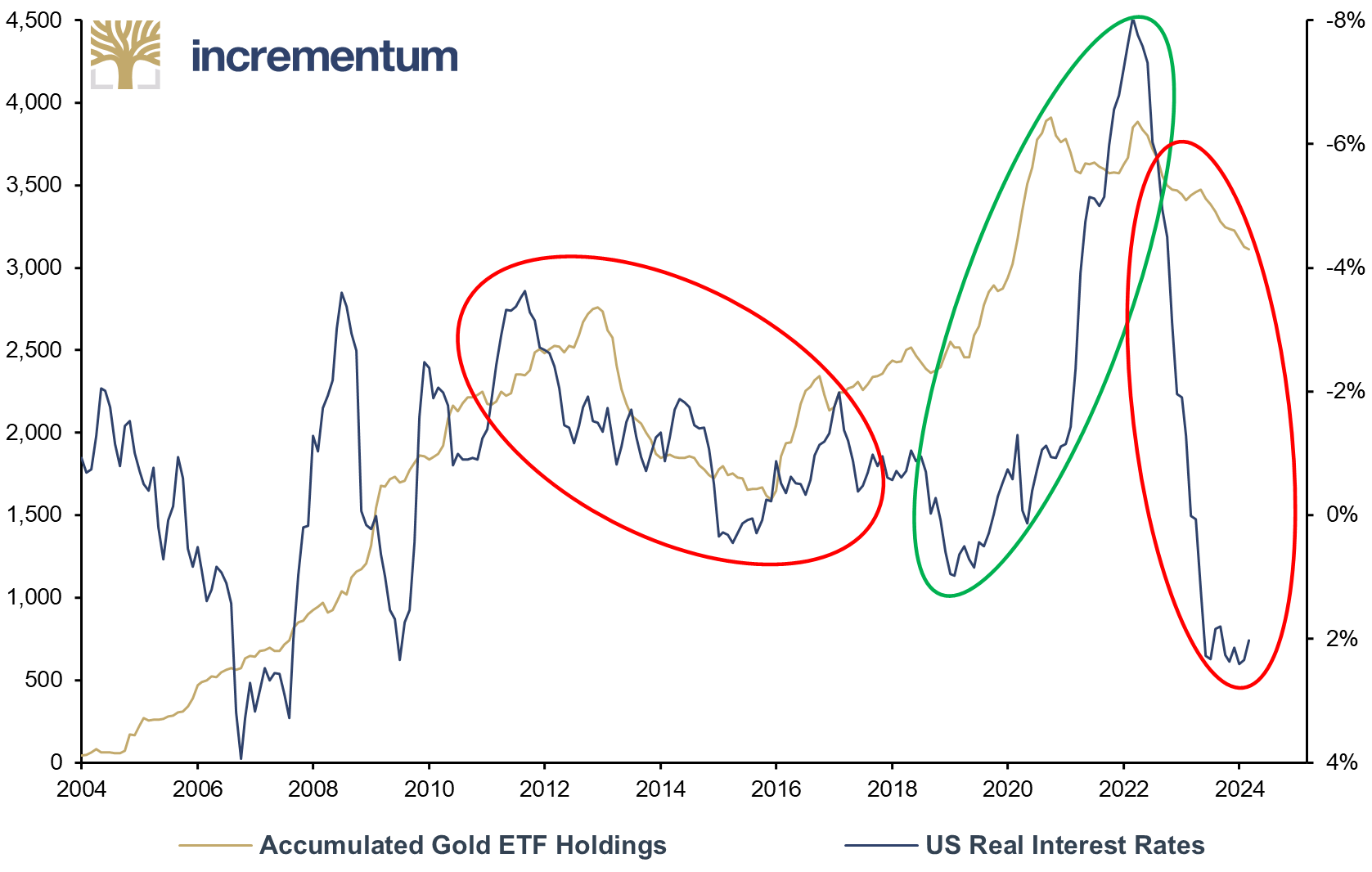

What is remarkable is that all of this is happening in an environment in which, according to the previous playbook, the gold price should actually have fallen. The collapse of the correlation between the gold price and real interest rates raises many questions. In the old paradigm, it was unthinkable that the gold price would trend firmer during a phase of sharply rising real interest rates.

Source: Reuters Eikon, Incrementum AG

This longtime pattern is not the only one that can no longer be used to explain the gold price trend. There is considerable evidence that the old set of rules has become outdated in essential aspects, indicating that it is time to adopt the new gold playbook.

Before we take a closer look at the details, the first question is: What is a playbook? ChatGPT provided us with the following answer:

A playbook is a comprehensive document or guide that outlines a set of strategies, procedures, or tactics to accomplish specific goals or objectives. It is commonly used in various fields such as business, sports, military, and politics. Playbooks provide step-by-step instructions, best practices, and tips for executing tasks efficiently and effectively. … Overall, a playbook serves as a reference tool to help individuals or teams navigate complex situations and achieve success.

We are convinced that gold will experience the same substantial revaluation under the new playbook as the queen did in the game of chess. Gold is no longer a marginal figure, just another investment opportunity among many, but is increasingly standing out from the spectrum of investment instruments.

What is the root of the fundamental changes in the gold market? Structural changes have taken place at various levels in recent years. A decade of zero and negative interest rate policies has atomized all risk premiums and provided a systemic incentive for excessive debt. The situation has been exacerbated by the Covid-19 measures and the massive costs of the green transformation, which are estimated to run at least USD 100trn by 2050 – almost the equivalent of the world’s annual GDP. Since the beginning of the Ukraine war, there has also been a vast increase in military spending. Adjusted for inflation, global military spending rose by 6.8% to USD 2.44trn in the previous year. This is the largest increase since 2009.

We have addressed and analyzed these complex changes affecting the gold market in detail in previous In Gold We Trust reports, such as in 2020 in “The Dawning of a Golden Decade”, in 2021 in “Monetary Climate Change”, in 2022 in “Stagflation 2.0” and, last but not least, last year in “Showdown”.

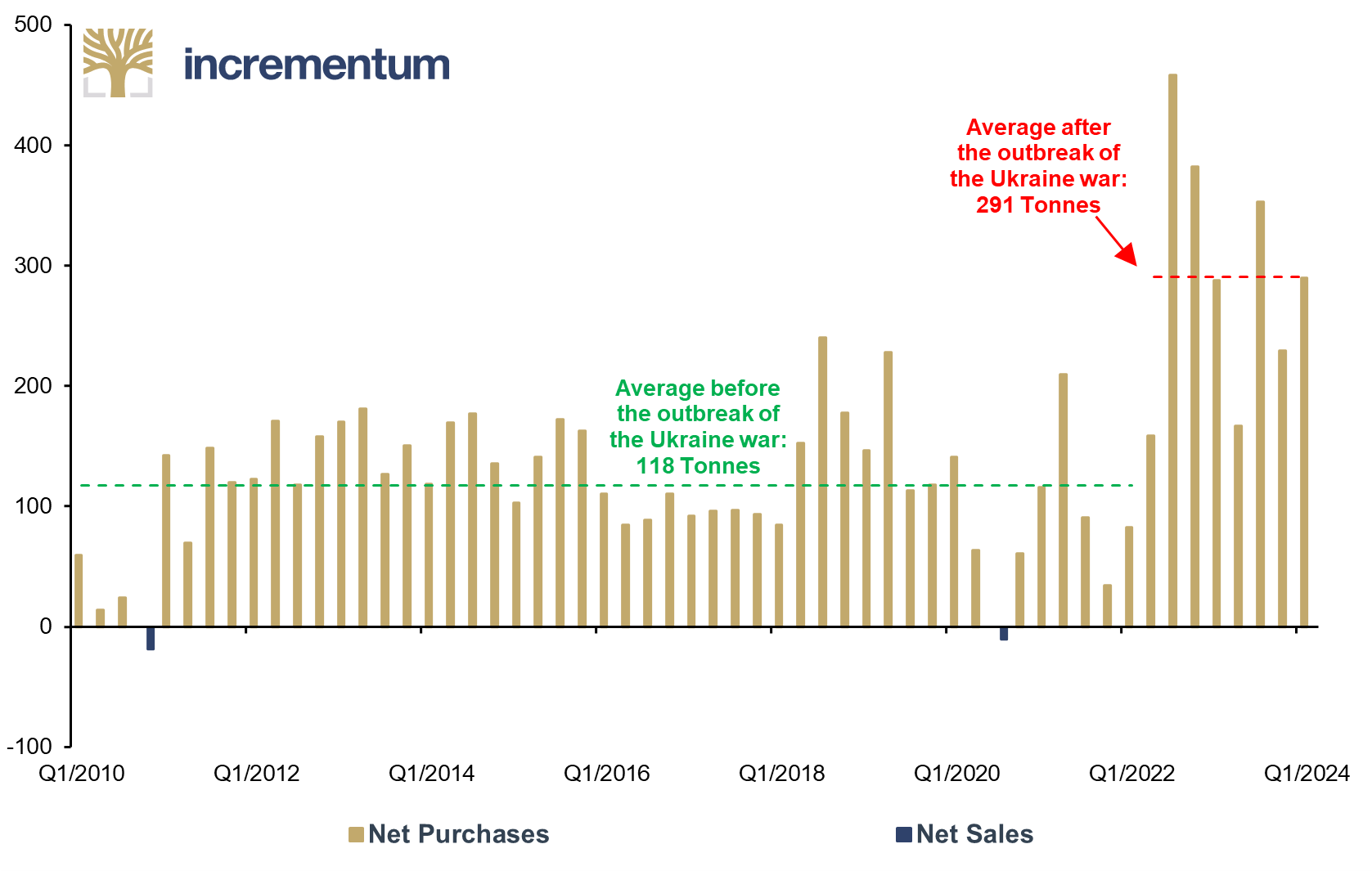

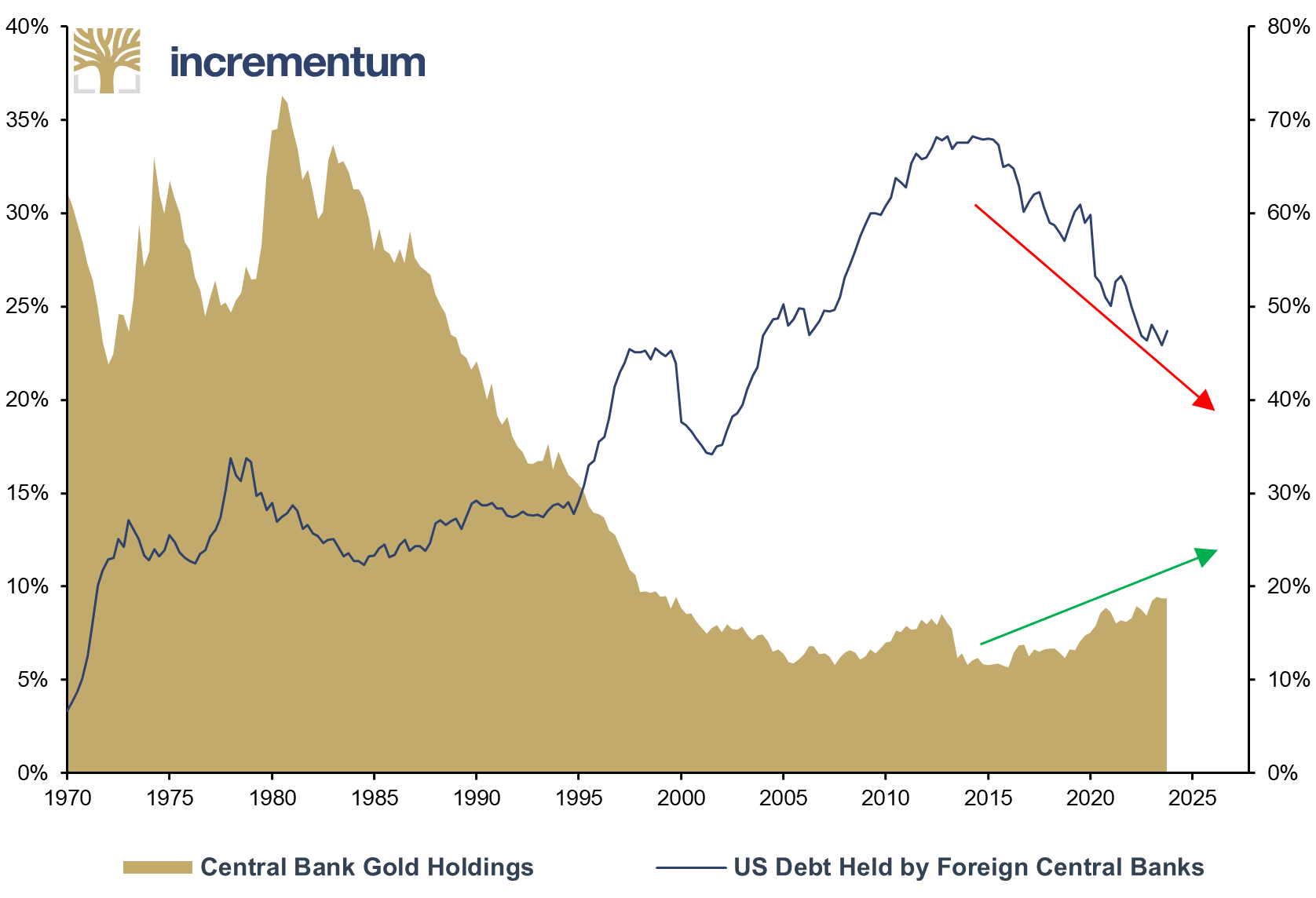

Amid one of the most challenging geopolitical tensions in decades, there is a return to gold as a neutral reserve asset. This is particularly evident in the record gold purchases by central banks. In the In Gold We Trust report 2022, “Stagflation 2.0”, we pointed out that the sanctioning of Russian currency reserves by the US and the EU would “go down in monetary history”.[2] And furthermore that “gold, as a neutral monetary reserve, will emerge as one of the beneficiaries of the troubling conflict between East and West”. As expected, one of the consequences of the momentous sanctions decision of February 26, 2022, is that international central banks have massively accelerated their gold purchases.

Source: World Gold Council, Incrementum AG

The freezing of Russian currency reserves impressively demonstrated to the world that debt-based currency reserves are ultimately just a promise and can be converted into worthless database entries in a moment in the event of a conflict. The uniqueness of gold as a neutral reserve currency without counterparty risk is now being rediscovered. The structural increase in central bank demand is a key piece of the new playbook, mainly because central bank demand is relatively less price sensitive. One could say that central banks have put a floor under the gold price.

Now, the geopolitical showdown is entering its next round. While the war in Ukraine continues to rage, the Middle East has become an additional arena of extraordinary geopolitical tension as a result of Hamas’ terrorist attack on Israel on October 7, 2023. The aggravated situation in the Middle East is a key pressure point in the complex network of international relations, with China and Russia on one side and the West on the other. The former are showing support for Iran and its allies, challenging the strength of the West’s traditional alliance with Israel. The following words by Zbigniew Brzezinski from his 1997 book The Grand Chessboard could prove prophetic:

Potentially, the most dangerous scenario would be a grand coalition of China, Russia, and perhaps Iran, an ‘antihegemonic’ coalition united not by ideology but by complementary grievances. It would be reminiscent in scale and scope of the challenge once posed by the Sino-Soviet bloc, though this time China would likely be the leader and Russia the follower.

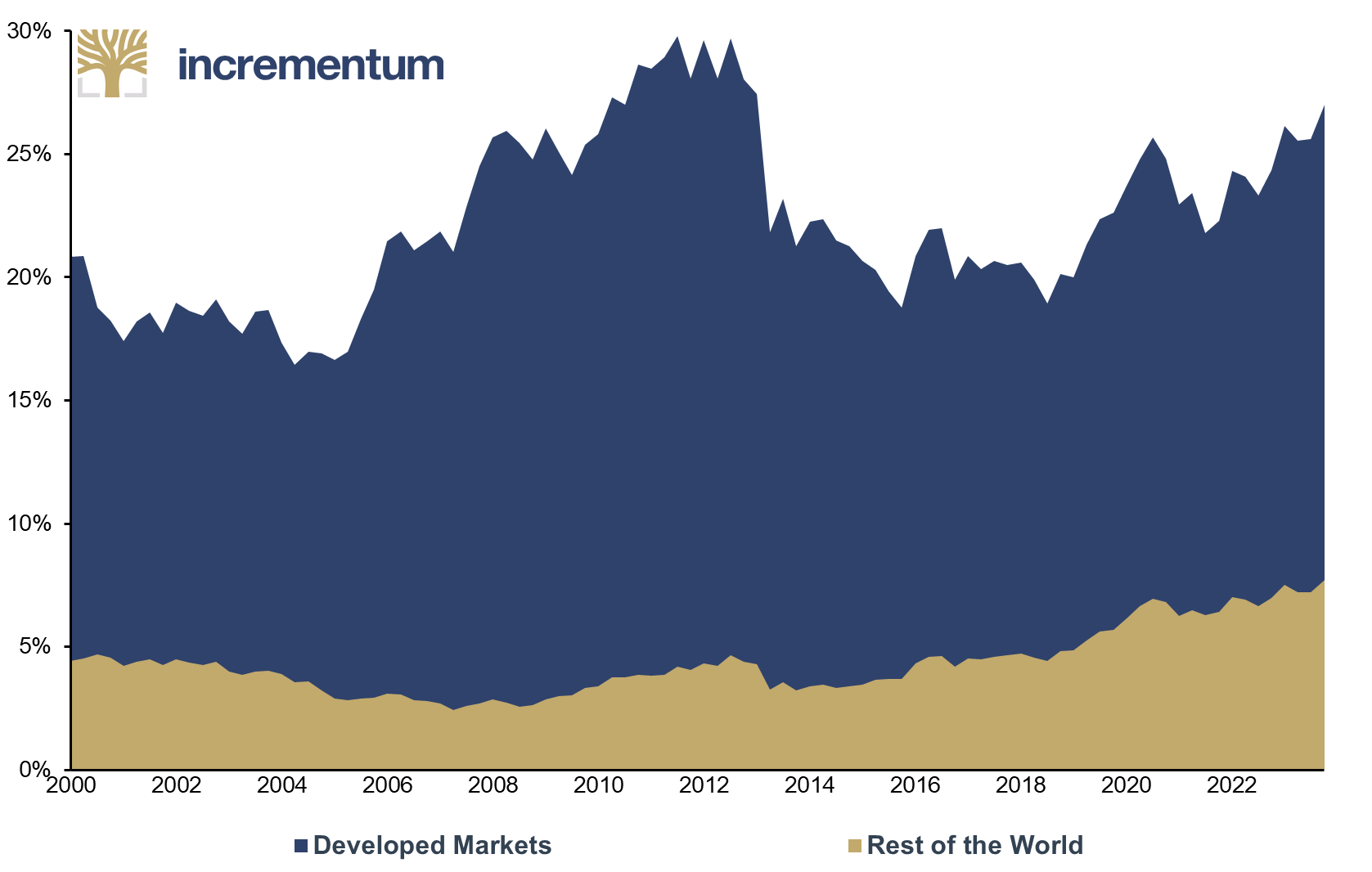

In 2024, around half of global GDP will be generated by emerging markets, compared to just 19% in 2000. Two-thirds of global GDP growth in the last 10 years was generated by the emerging markets. The majority of emerging

markets have a much greater penchant for gold than the industrialized nations. This will feed a natural, long-term growth in demand for gold.

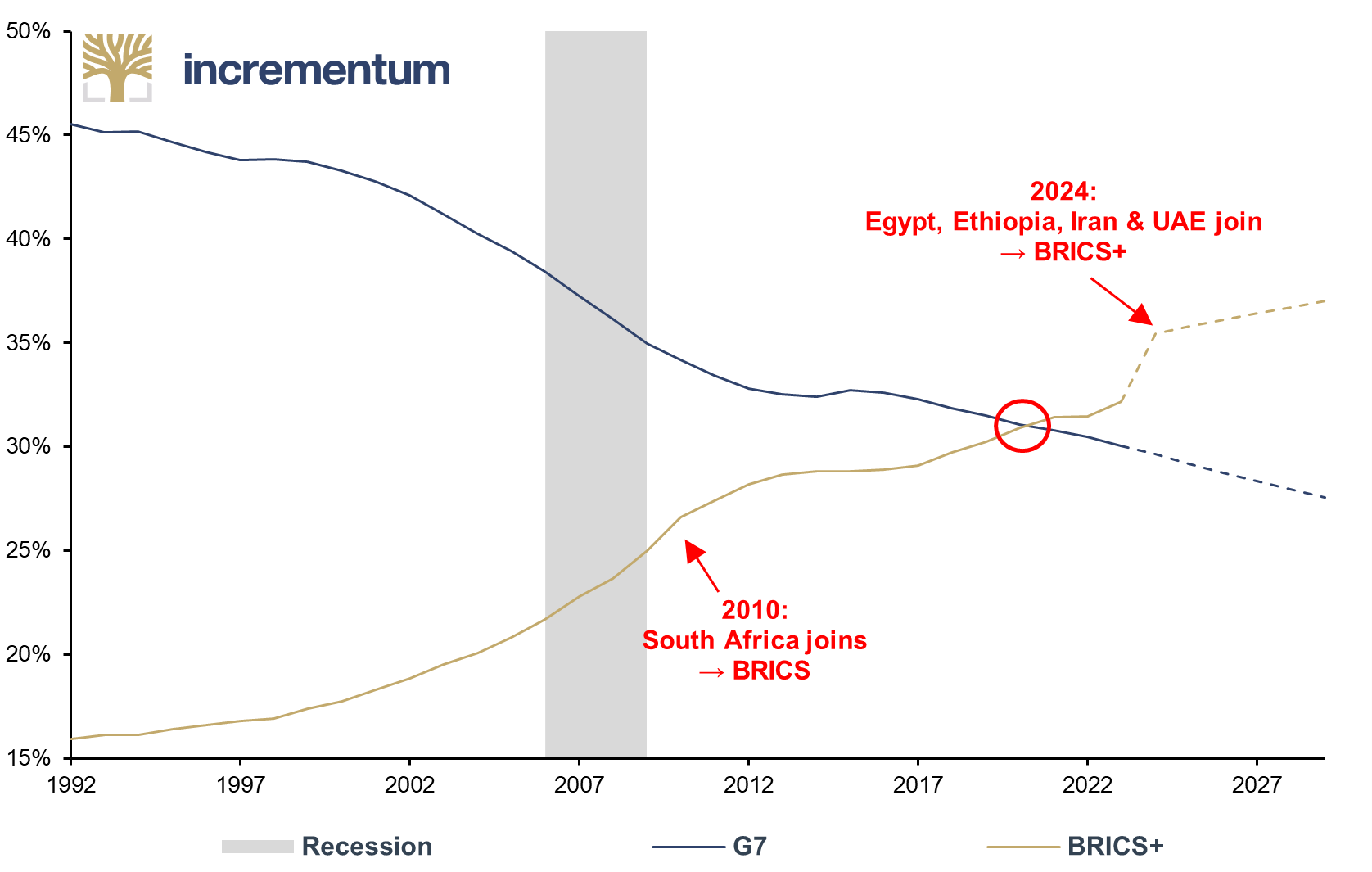

The increasing economic and political importance of emerging countries has been apparent for many years. It seems that dissatisfaction with the prevailing international order is growing day by day. Various international institutions, which are largely dominated by the West, are increasingly being called into question, while the alliance around the BRICS states is experiencing strong growth.

At the beginning of this year, four new member states were admitted to BRICS: Egypt, Ethiopia, Iran and the United Arab Emirates. Saudi Arabia, which is gaining geopolitical influence, is also likely to join the alliance but has not yet officially confirmed its acceptance of the invitation to join BRICS+. The hesitation shows that joining is seen as a historic decision. Including Saudi Arabia, the BRICS+ would account for 43% of global oil production and 44% of global oil reserves.

Source: Acorn MC Ltd, World Economic Outlook, Reuters Eikon, Incrementum AG

For years, the BRICS+ countries have had a considerable trade and current account surplus with the West. A steadily increasing share of gold in the currency reserves of emerging economies is the manifestation of this development. This is similar to the situation after the Second World War, when Europe, especially Germany and France, successively increased their gold reserves as a result of high current account surpluses. In contrast, US gold reserves fell to almost one quarter, or just over 8,000 tonnes, as a result of the gold drain. While the US experienced a gold drain in the 1960s, there are currently signs of a gold gain in the emerging markets. [3]

The renaissance of gold is also reflected in the fact that the World Bank published a “Gold Investing Handbook for Asset Managers” at the end of February. It explicitly cites several studies that impressively confirm the properties of gold as a diversifier, particularly in the event of downward volatility. Central banks are recommended to hold up to 22% gold. [4]

Source: World Gold Council, Incrementum AG

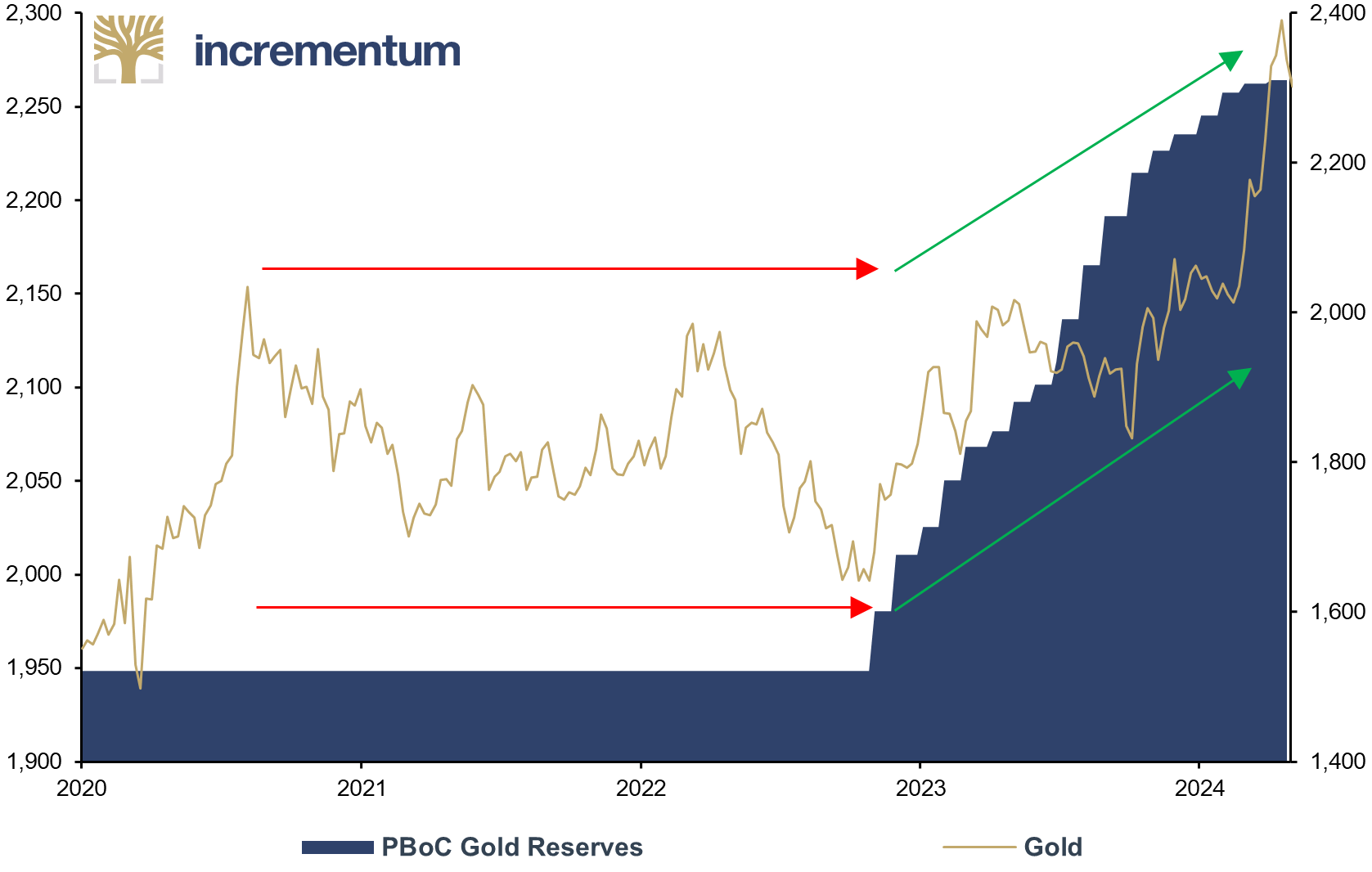

Among the central banks, the PBoC in particular is continuously expanding its gold reserves. Including March, purchases have been registered for 18 consecutive months. The chart below shows that the low point of gold prices in 2022 fell in the same month in which the Chinese central bank’s gold purchases picked up speed.

Source: World Gold Council, Reuters Eikon, Incrementum AG

Loyal readers know that we have been analyzing the ongoing process of de-dollarization for many years. [5] The term de-dollarization is naturally interpreted in different ways. To clarify: We do not believe that this process will lead to the US dollar being replaced by another fiat currency as the world’s reserve currency. Among the “blind” fiat currencies, the “one-eyed” US dollar is king for the time being. In the competition between the BRICS+ and the US dollar team, the latter has recently been able to score a success. Argentina, under its new libertarian president Javier Milei, has decided to turn down the invitation to join BRICS+ and instead tie itself more closely to the US dollar and to NATO.

The BRICS+ countries are likely to launch the next round of this ongoing competition at their annual conference, which will take place in Russia at the end of October. Numerous countries, from Kuwait to Venezuela, Thailand, Kazakhstan, and Nigeria are considered candidates for membership. Among the countries that have expressed an initial interest in BRICS+ membership are two countries with geopolitical explosiveness: Turkey, a NATO member country, and Mexico, a direct neighbor to the US.

There are many indications that the bipolar global order that has begun to emerge in recent years is continuing to take shape. Back in March 2022, Zoltan Pozsar’s article “Bretton Woods III” gave a stimulating impetus to this debate about a new global monetary order. He concluded his remarks with the following prediction: “From the Bretton Woods era backed by gold bullion, to Bretton Woods II backed by inside money (Treasuries with unhedgeable confiscation risks), to Bretton Woods III backed by outside money (gold bullion and other commodities).” [6]

No one knows exactly where this journey will take us. However, there is no question that we are irrevocably on the road to a new global (monetary) order. For state actors such as central banks and sovereign wealth funds, gold is increasingly becoming the golden queen on the geo-economic chessboard.

Source: Crescat Capital, Reuters Eikon, Incrementum AG

It is not only state actors in emerging markets that are experiencing gold fever but also private individuals. Loyal readers will be familiar with our theory that gold has always moved out of countries where the capital stock is being depleted and into countries where capital is being built up, where the economy is prospering and the volume of savings is increasing. The Romans had already experienced this more than 2,000 years ago, when the Chinese and Indians only accepted gold in exchange for spices and silk and not Roman goods.

In terms of annual physical demand for gold, the share of emerging markets has risen to 70% over the past five years. China and India have accounted for more than half of this. The formative historical experience of financial repression, with an unstable monetary system and the associated loss of purchasing power – apart from cultural and religious aspects – is likely to be the decisive factor for the higher basic demand for gold. The following chart shows how high the correlation between the economic development of the emerging markets – measured by the MSCI Emerging Markets – and the gold price has become. However, the chart also shows that since 2022 the correlation has decreased, and a divergence has occurred.

Source: Reuters Eikon, Incrementum AG

The simplified formula can therefore be stated as follows: If you want to bet on long-term growth in emerging markets, you should bet on gold as well. Or, as Louis-Vincent Gave put it: “Gold is a low-beta emerging market proxy.”

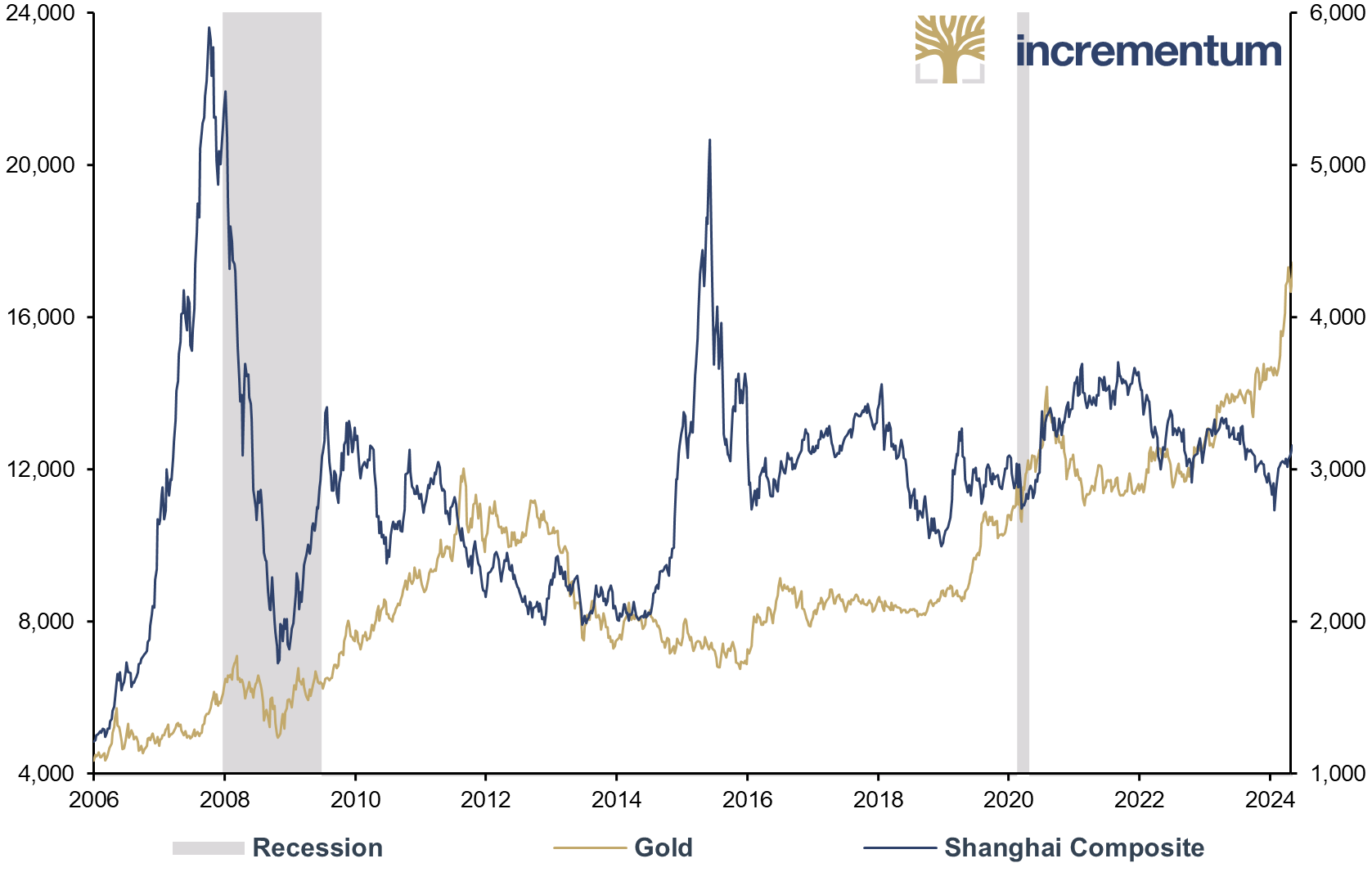

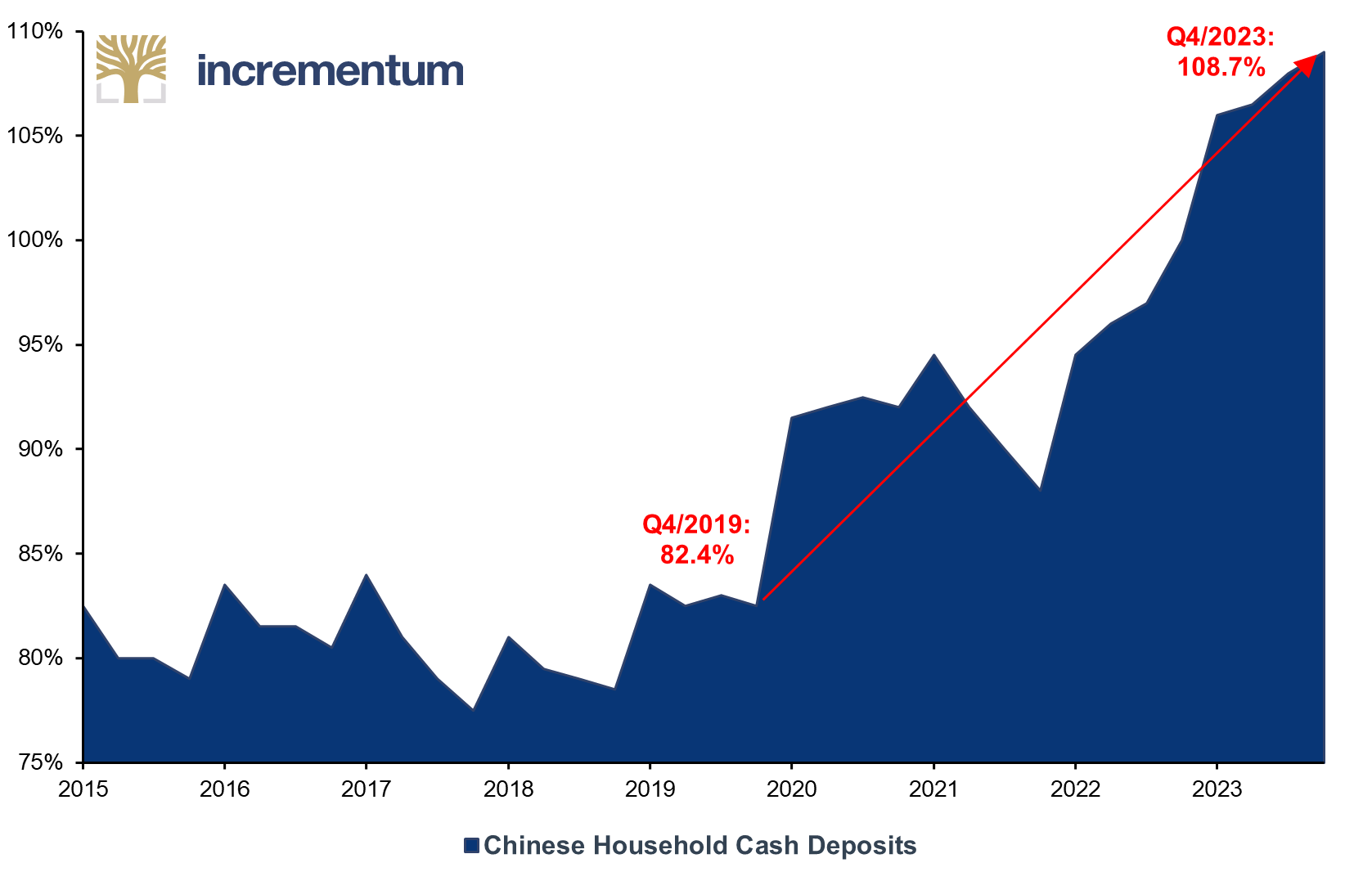

One of the most important factors behind the recent gold boom is undoubtedly the enormous demand from China. Chinese demand for gold is no longer being fueled solely by the PBoC, but increasingly also by Chinese private investors. The financial situation in China could be summarized as “shrinking pool of investment opportunities meets high liquidity”.

Now that the Chinese real estate market, traditionally used for retirement provision, has hit turbulence, there is a substantial need for alternatives. Chinese bonds and savings accounts are also becoming less attractive in view of the ongoing decline in interest rates, while Chinese equities have been trending sideways (volatile) since 2016. Despite a rally of 15% from February to the end of April, the leading Chinese stock indices are still well below their historical highs.

Source: Reuters Eikon, Incrementum AG

These uncertainty factors combined with continued high liquidity – the Chinese population’s cash holdings are at a record high – create superior conditions for investing in gold. In addition, it is worth noting how the Chinese horoscope influences the investment culture. 2024 is under the sign of the dragon, which symbolizes vitality, power and dominance in the Chinese zodiac. This boosts the appreciation of solid, stable investments such as gold.

Source: Longview Economics, Macrobond, Incrementum AG

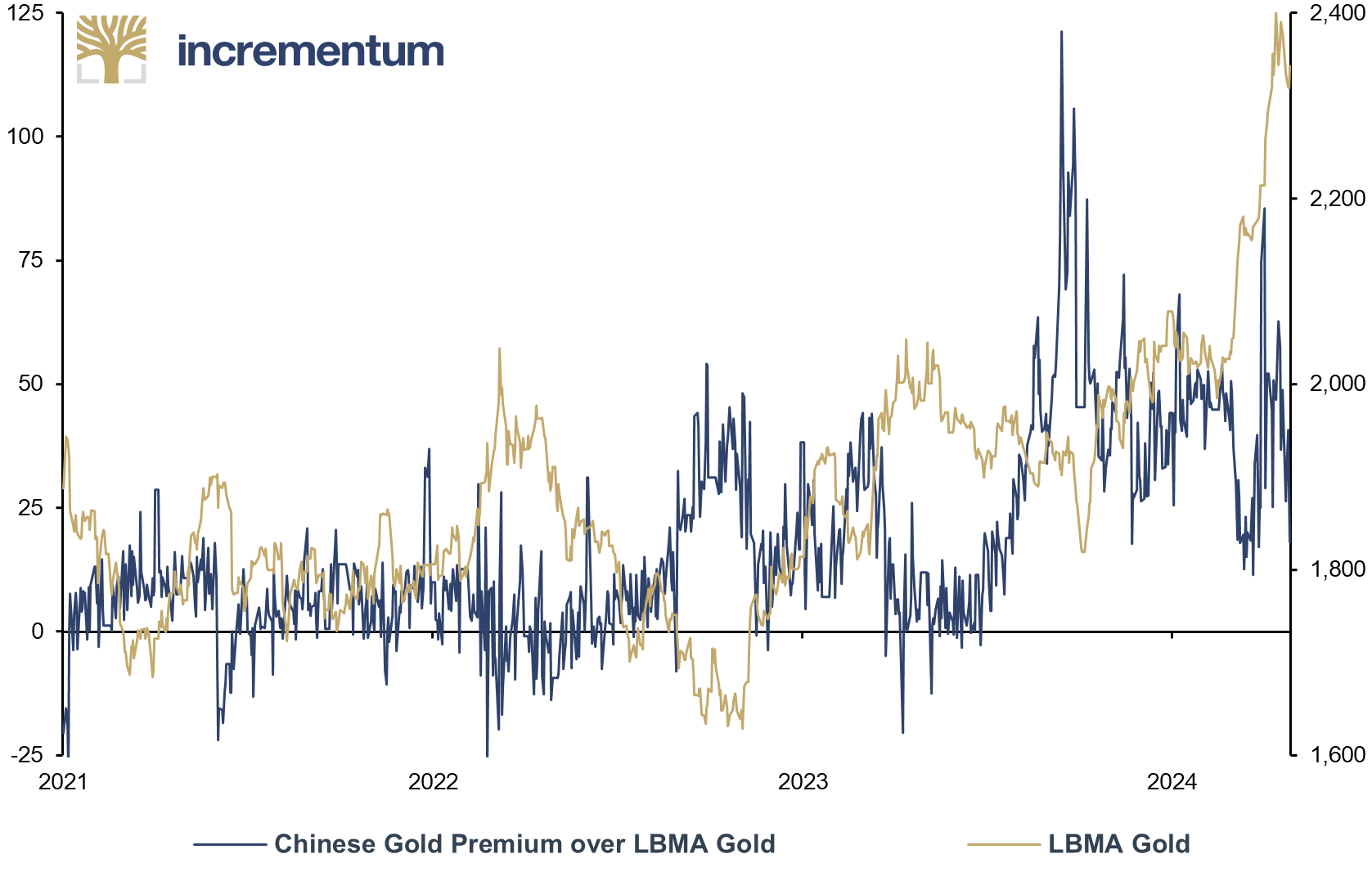

The enormous Chinese appetite for gold can be seen in the premium for Chinese gold compared to LBMA prices. The high domestic demand in China is also being fueled by China’s youth, who have recently discovered gold beans as an investment opportunity. In addition, import restrictions or tariffs on gold imports could keep prices in China artificially high. Another reason is likely to be China’s withdrawal from the LBMA gold auctions last year, which may have restricted the volume of gold flowing into China.

Source: World Gold Council, Incrementum AG

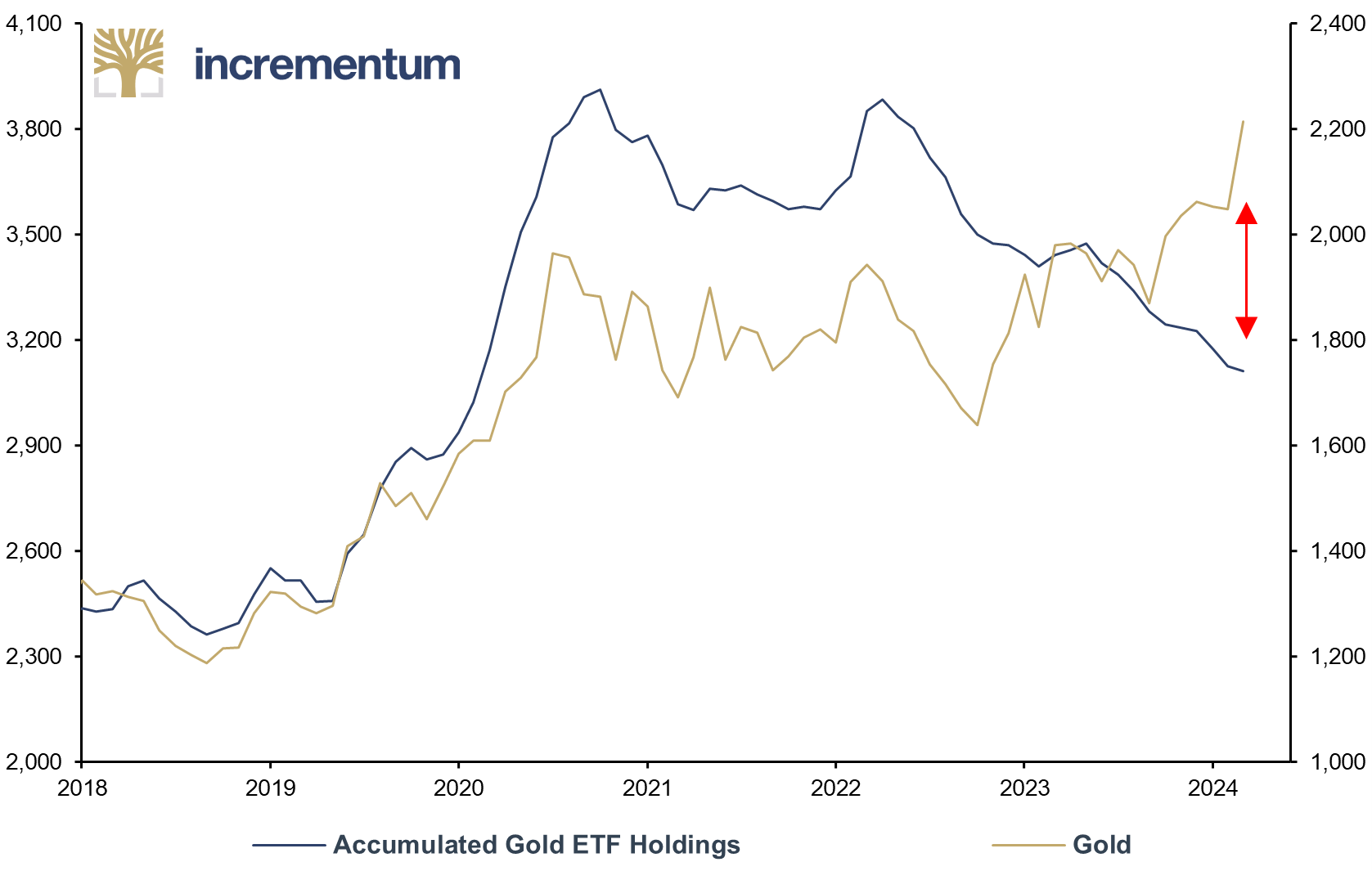

The picture in the West is very different from that in the emerging markets. The once strong link between investor demand from the West and the gold price has dissolved in recent quarters. In view of gold’s record run, one would have expected ETFs to register record inflows. First, things turn out differently, and second, they unfold contrary to expectations: Since April 2022, there was a net outflow of around 760 tonnes of gold from ETFs. According to the old gold playbook, gold should be at around USD 1,700 in view of the fall in ETF holdings.

Source: World Gold Council, Incrementum AG

Consequently, a key element of the new gold playbook is that the Western financial investor is no longer the marginal buyer or seller of gold. [7] The significant demand from central banks and private Asian investors is the main reason why the price of gold has been able to thrive even in an environment of rising real interest rates.

How can the declining interest of Western financial investors in gold actually be explained? In our opinion, it seems that Western investors are stubbornly sticking to the old playbook for gold: rising real interest rates translate into a lower gold price and therefore lead to net-negative gold sales.

Source: World Gold Council, Incrementum AG

A reduction in gold ETF holdings when real interest rates rise is certainly a rational decision from the point of view of the players in the West, provided they assume that:

In our opinion, all three assumptions should be questioned – and that sooner rather than later:

Assumption 1:

Even if counterparty risk is generally ignored when investing in Western government bonds, the sharp rise in government interest payments in particular is causing growing unease. Any remnants of budgetary common sense have been completely thrown overboard, most recently in the context of Covid-19 policy.

This monetary climate change – as we called it in the In Gold We Trust report 2021 – has continued even after the end of the pandemic. However, this budgetary nonchalance is now taking place in an environment of sharply rising interest rates and no longer one of low or even negative interest rates. Around 10 times as much had to be spent on interest payments for German federal debt in 2023 than in 2021.

Source: German Financial Agency, Incrementum AG

An etatist attitude has prevailed in many countries. Fittingly, this year marks the 80th anniversary of the publication of The Road to Serfdom, by Friedrich A. Hayek. The Austrian economist famously dedicated this book to socialists of all parties. In addition to exorbitantly expensive projects such as the Inflation Reduction Act and the European Green Deal and the sharp rise in spending on a social system that is structurally insolvent as a result of ageing and immigration, Western governments are now looking for sources of funding to finance the announced increases in military spending.

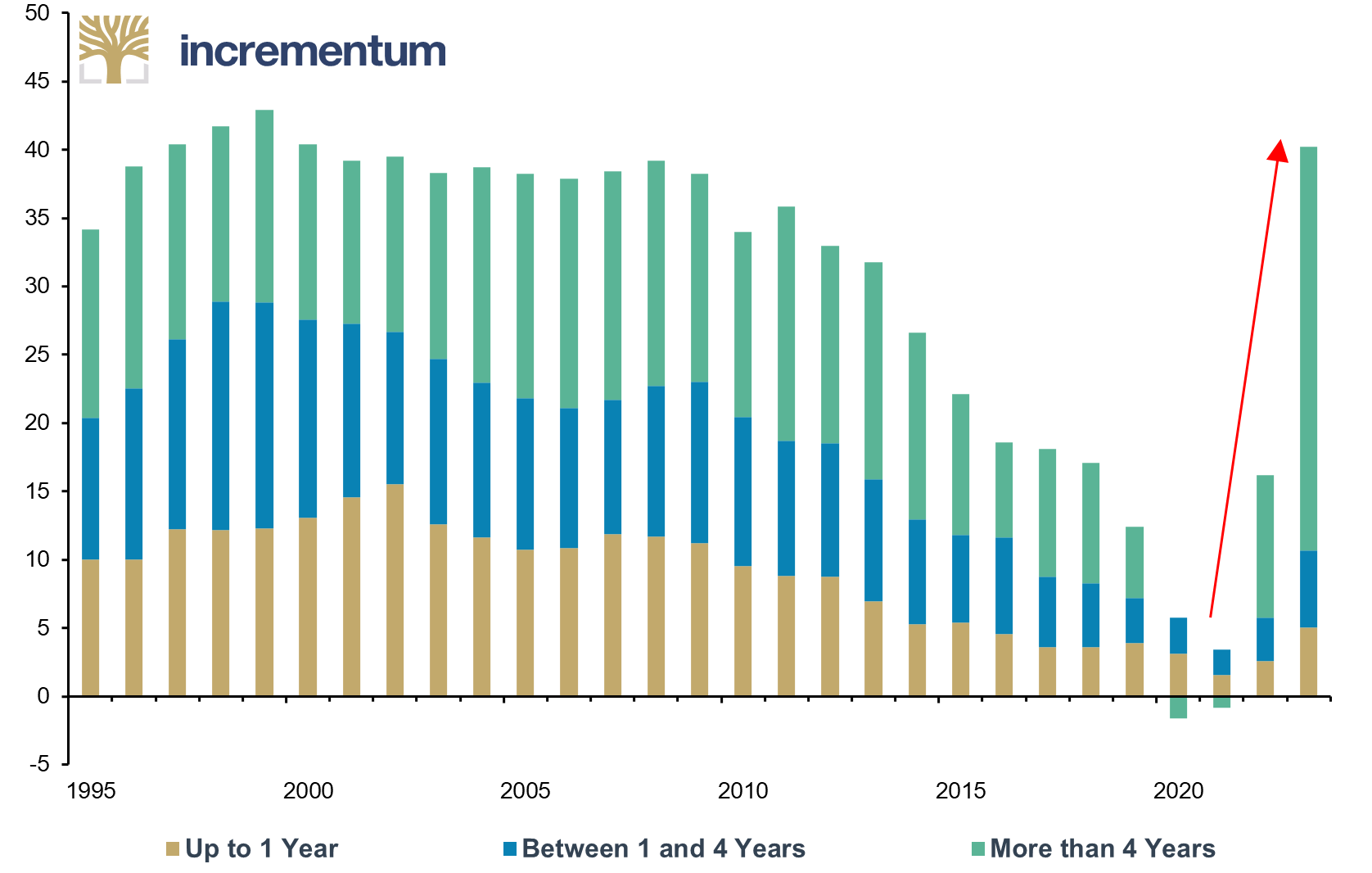

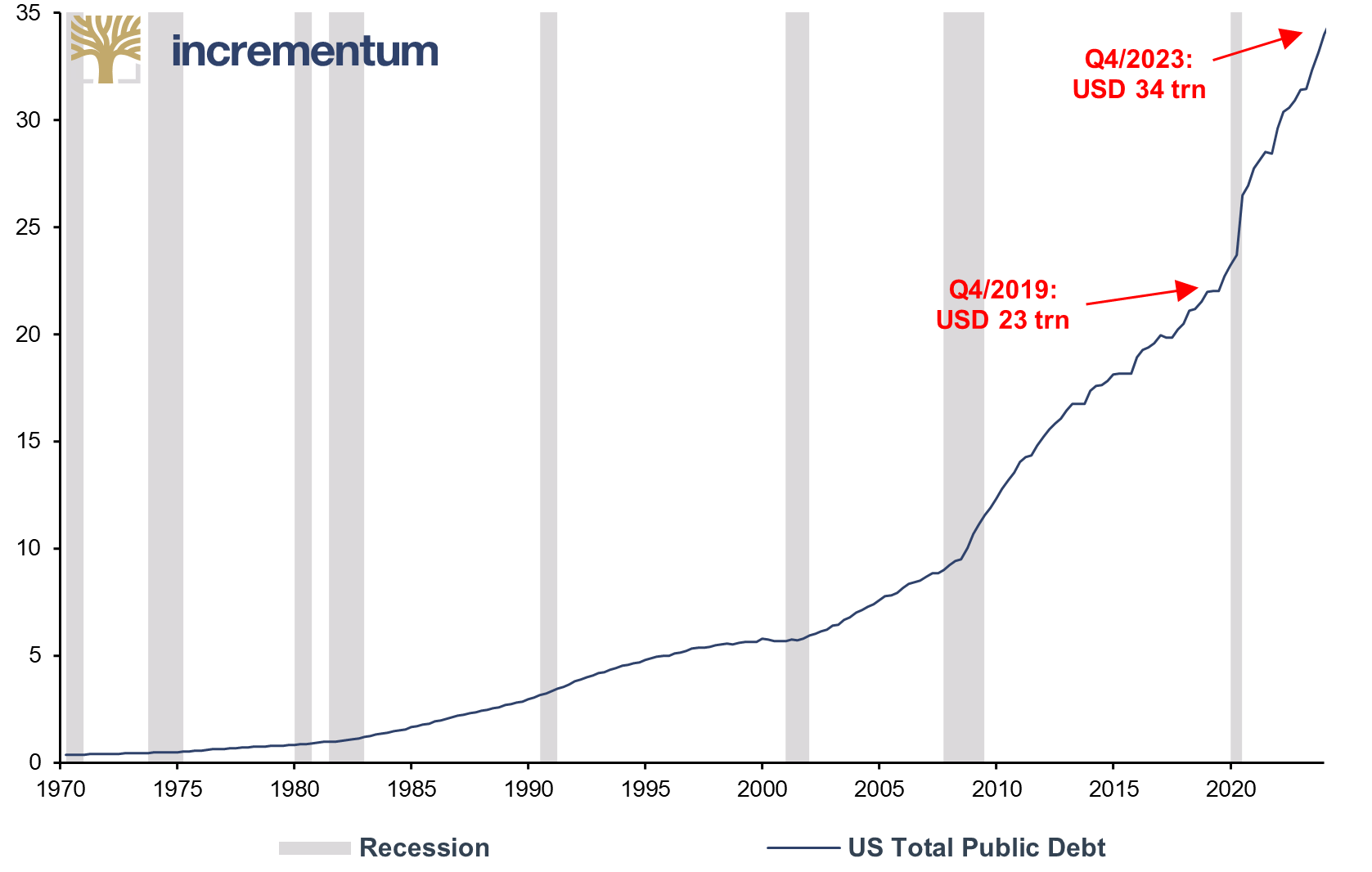

In addition, the already precarious budgetary situation of many countries is deteriorating due to the recent surge in interest rates. The significant increase in national debt in the wake of the Covid-19 pandemic and the energy crisis must also be digested. Compared to Q4/2019, i.e. the eve of the pandemic, US debt has risen by USD 11trn – and thus by around 50%.

Source: Reuters Eikon, Incrementum AG

Assumption 2:

Historically, overindebtedness has usually led to government financing by central banks, increased financial repression, and the use of inflation taxes. If this were to happen, real interest rates would fall again due to a new wave of inflation and, obviously, all the arguments would then speak in favor of investing more in gold.

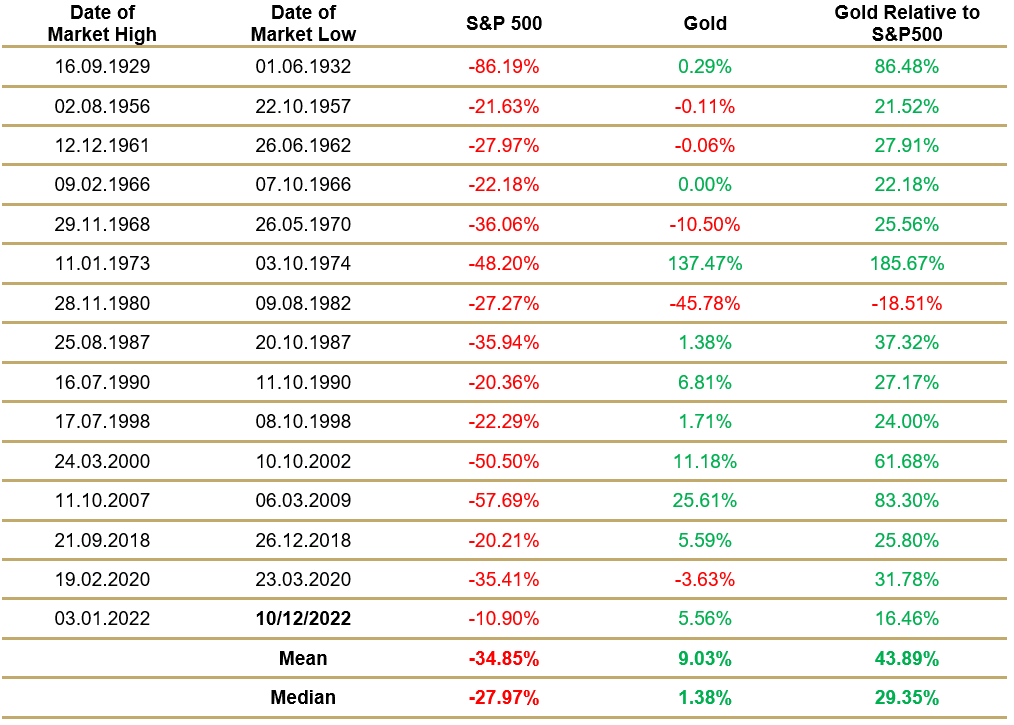

Assumption 3: In the event of a weakening stock market, the opportunity costs would be low from the perspective of a potential gold investor. A slide in equity markets would probably be expected in the event of a significant slowdown in the US economy, and even more so if the US slipped into recession. Conversely, history has shown that gold has typically been an excellent portfolio component during recessions. We published an extensive analysis of this in the In Gold We Trust report 2023. [8]

Source: Reuters Eikon, Incrementum AG

Because Western financial investors in particular have not yet realized that there is a new version of the gold playbook, gold remains on everyone’s lips but is far from being in all portfolios. It seems that Western investors initially turned down the invitation to the gold party. Now that the party is gaining momentum, they do not want to admit they were party poopers. It could therefore happen that they will only come to this party when it is already in full swing, and then at a much higher “price of admission”.

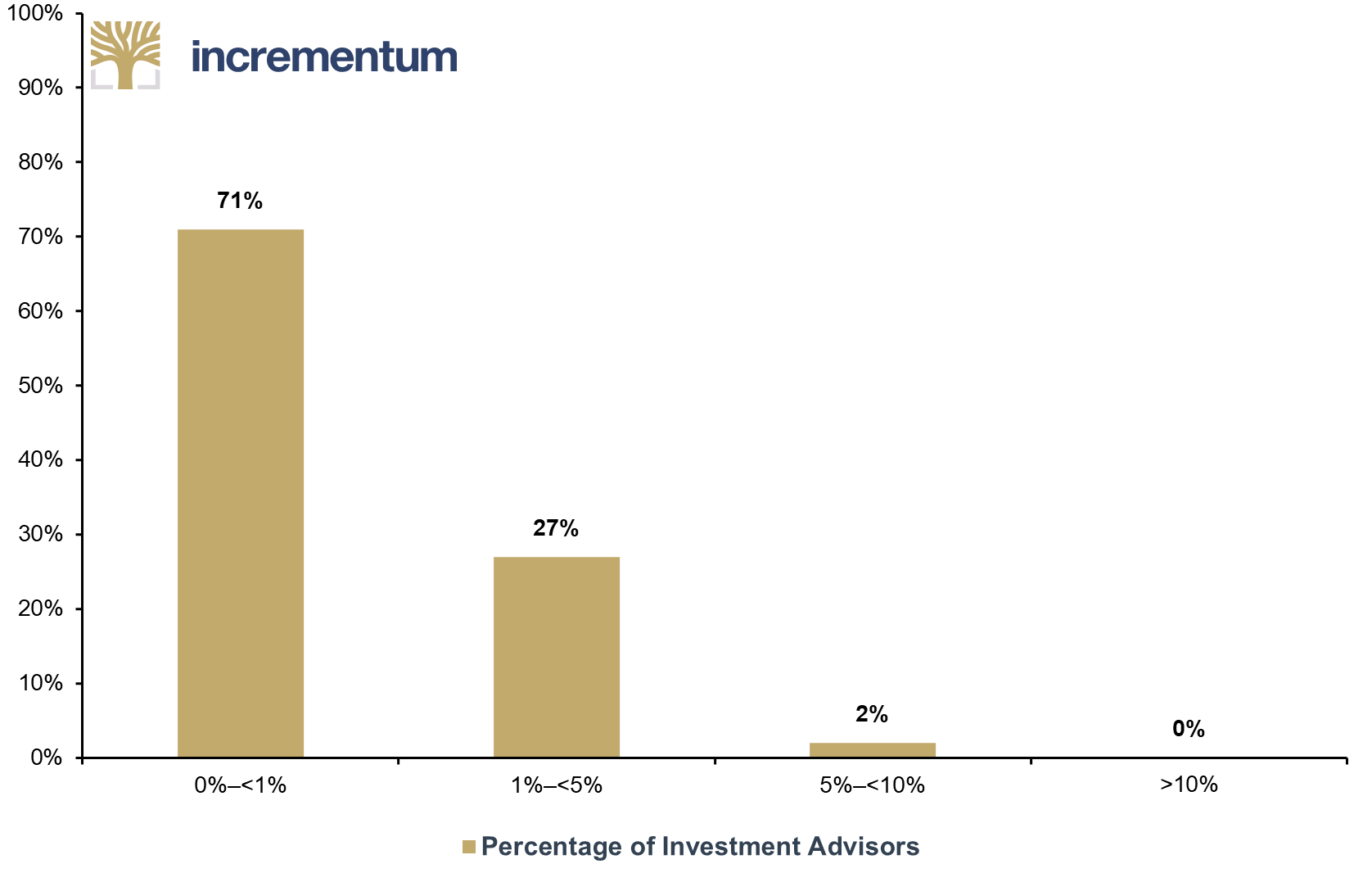

The low affinity for gold among large sections of the investment community was recently confirmed by a Bank of America study. In fact, 71% of US advisors have little to no gold allocation, i.e. it is less than 1% of their portfolio. We also see a similar lack of interest in gold mining stocks, which have largely lost the trust of investors in view of their disappointing performance.

Source: BofA Global Research, Crescat Capital, Incrementum AG

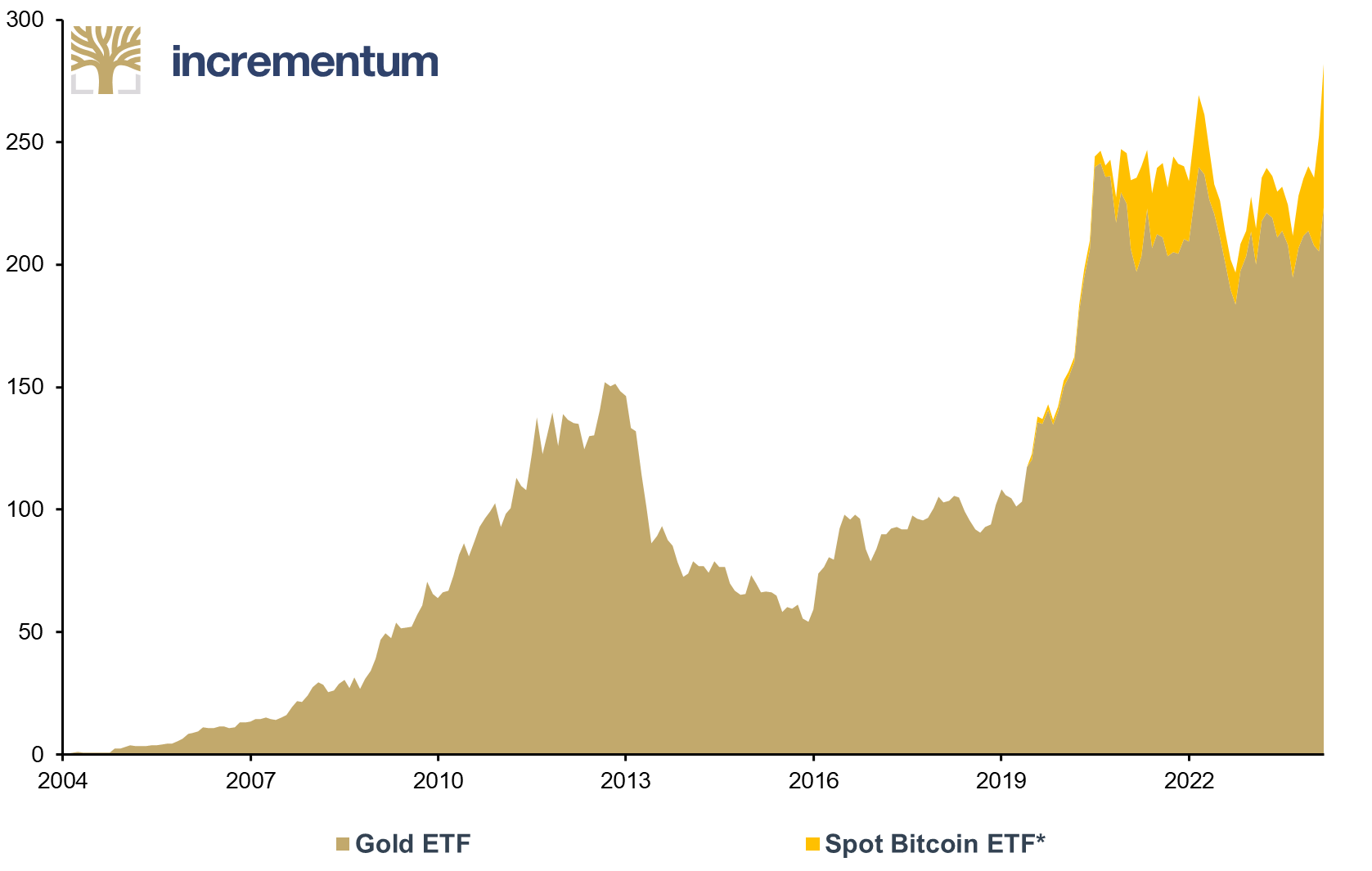

A key new aspect of the new gold playbook is that Bitcoin has established itself as a serious competitor to gold. The digital currency is challenging the status of the precious metal as the most important non-inflationary store of value.

Source: hildobby, Reuters Eikon, Incrementum AG

*GBTC Holdings for the Period prior to Spot Bitcoin ETF Trading (01/11/2024)

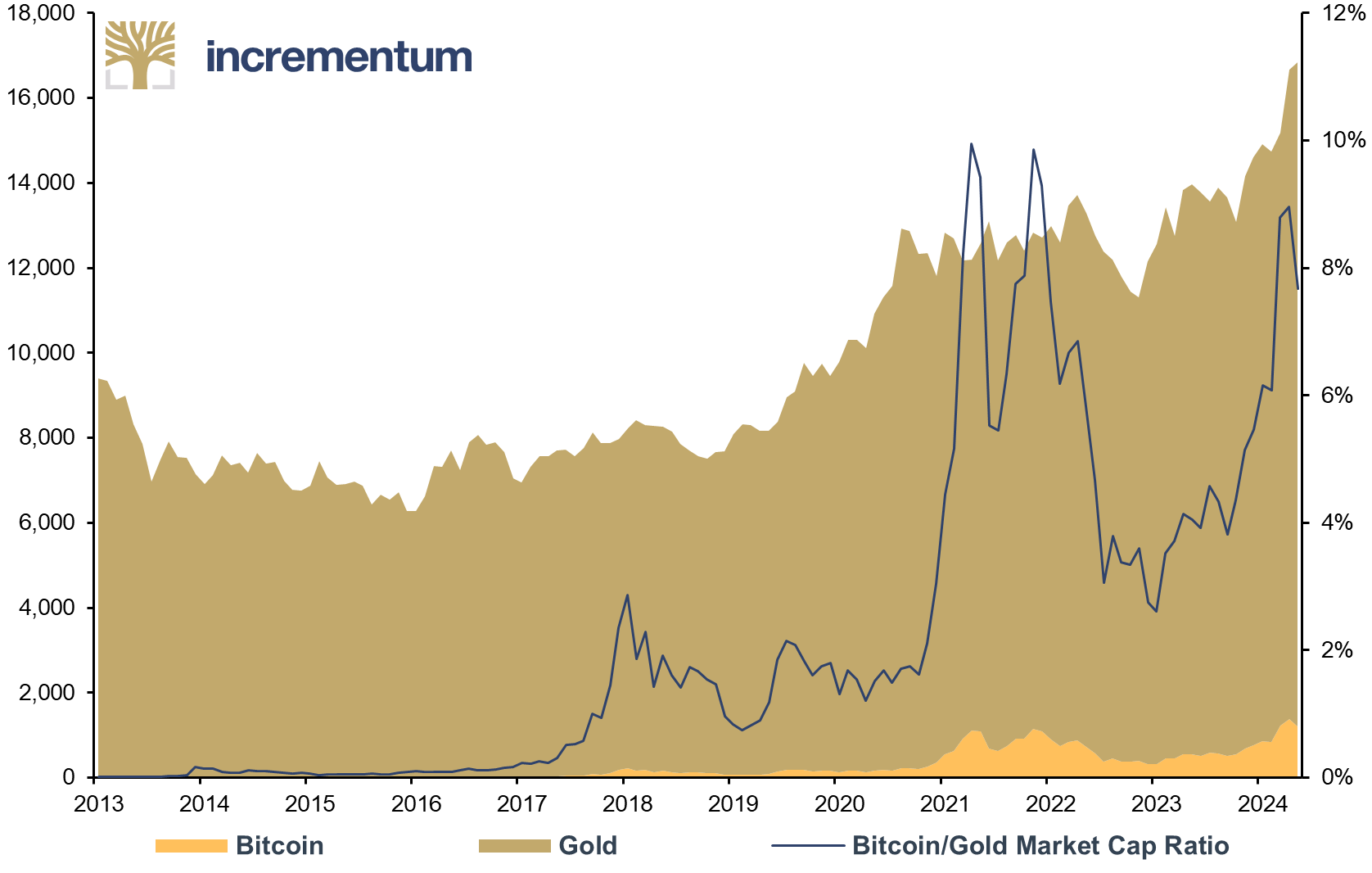

However, there is still a very long way to go before Bitcoin could outstrip gold. As of April 30, the market capitalization of all mined gold was around USD 15.6trn– 212,582 tonnes at a price of USD 2,288 per ounce. For Bitcoin, the current price of USD 60,600 per coin results in a market capitalization of USD 1.2trn. This corresponds to around 7.7% of the market capitalization of gold. Assuming an unchanged gold price, the BTC price would need to nearly triple to, for example, reach 20% of the market capitalization of gold.

Source: Reuters Eikon, World Gold Council, coinmarketcap.com, Incrementum AG

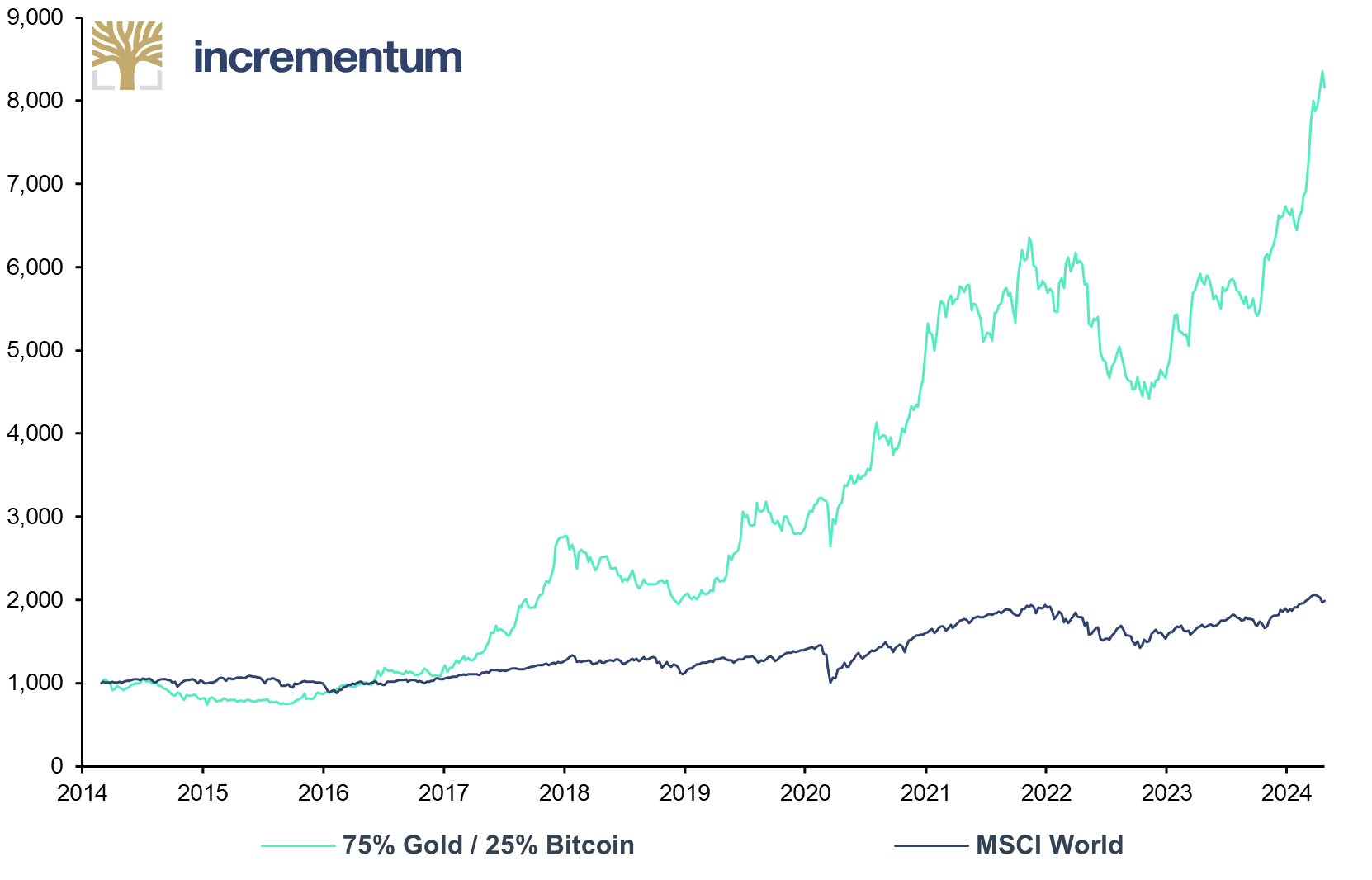

However, the fact that gold has gained new competition in the universe of noninflationary assets need not be detrimental to gold per se. In line with the motto “Competition is good for business”, it is quite conceivable that a critical examination of the unsustainability of the current monetary system could lead more and more investors to realize that, from a portfolio perspective, a combined investment in gold and Bitcoin is superior to the respective individual investments on a risk-adjusted basis. For years, our credo has been: “Gold for stability, Bitcoin for convexity.“ [9]

Source: Reuters Eikon, Incrementum AG

*Weekly Rebalancing

“Almost all books on gold are boring”, is how Roland Baader begins the foreword to his book Gold: Last Resort or Catastrophe?. With our In Gold We Trust report, we try to prove the opposite in an informative way: Gold is always interesting, because it reflects the state of the global economy, the monetary architecture, and also society. Year after year, the In Gold We Trust report strives to live up to its reputation as “the gold standard of gold studies” and to be the world’s most recognized, most widely read, and most comprehensive analysis of gold. You, dear readers, are our greatest incentive.

Every year, we retreat to our bower for a few weeks to reflect, research facts and figures, and finally write the In Gold We Trust report. After all, we not only want to offer you a comprehensive analysis of current developments, but also to present historical, philosophical, and theoretical economic insights on the topic of gold. We are happy to admit that this is somewhat easier for us in years when the price of gold significantly increases.

This 18th edition of the In Gold We Trust report features a premiere: For the first time, our newly founded Sound Money Capital AG is acting as publisher. However, the In Gold We Trust report continues to be published in cooperation with Incrementum AG. We would like to take this opportunity to thank our partners at Incrementum AG, who support us as experienced sparring partners in matters of market analysis, company valuation and fund management.

We would also like to thank our more than 20 fantastic colleagues on four continents [10] for their energetic and tireless efforts over more than 20,000 hours and countless time zones.

Last but not least, special thanks go to our premium partners. [11] Without their support, it would not be possible to make the In Gold We Trust report available free of charge and to expand our range of services year after year. In addition to the annual publication in four languages, we provide our Monthly Gold Compass every month as well as ongoing information on our In Gold We Trust report homepage at ingoldwetrust.report.

We believe that dealing with the past is essential to successfully preparing for the future. This examination has led us to the conviction that now is the time for a new gold playbook. We would like to present this to you, our valued readers, as a guide to the topic of gold in the more than 420 pages of the In Gold We Trust report 2024.

Now we invite you on our annual expedition and hope that you enjoy reading our 18th In Gold We Trust report as much as we have enjoyed writing it.

With best regards from Liechtenstein,

Ronald-Peter Stöferle and Mark J. Valek

[1] Like the queen, the bishop’s ability to move has also been extended. Originally the bishop could only jump two squares diagonally, but after the rule change it could move any number of squares diagonally. This change increased the range and effectiveness of the bishop. After the rule change, the pawns could also move two squares forward in the starting position instead of always making only one move forward.

[2] “Introduction: of Wolves and Bears,” In Gold We Trust report 2022, p. 9

[3] See “The Rise of Eastern Gold Markets: An Impending Showdown with the West,” In Gold We Trust report 2023 ; “From West to East: Gold’s Flow into the ‘Strong Hands’ of Asia,” In Gold We Trust report 2020

[4] We have published an in-depth analysis of this astonishing World Bank study on X.

[5] See, i.a. “De-Dollarization: The Final Showdown?,” In Gold We Trust report 2023; “A New International Order Emerges,” In Gold We Trust report 2022; “De-Dollarization 2021: Europe Buys Gold, China Opens a Digital Front,” In Gold We Trust report 2021; “De-Dollarization 2020 – The Endgame Has Begun,” In Gold We Trust report 2020

[6] See also “Exclusive Interview with Zoltan Pozsar: Adapting to the New World Order,” In Gold We Trust report 2023

[7] See, among others, “The Rise of Eastern Gold Markets: An Impending Showdown with the West,” In Gold We Trust report 2023; “From West to East: Gold’s Flow into the ‘Strong Hands’ of Asia,” In Gold We Trust report 2020

[8] See “The Showdown in Monetary Policy,” In Gold We Trust report 2023

[9] You can find more information on our investment strategies at www.incrementum.li/en/investment-funds/. For Bitcoin enthusiasts, we also offer a quarterly publication, the Bitcoin Compass. You can download it free of charge at www.incrementum.li/en/btc-compass/.

[10] All colleagues are pictured in the gallery at the end of the In Gold We Trust report

[11] At the end of the In Gold We Trust report you will find an overview of our Premium Partners, including brief descriptions of the companies.

Erhalten Sie die den jährlich erscheinenden In Gold We Trust-Report sowie das Chartbook mit den dazugehörigen Charts, indem Sie sich für unseren In Gold We Trust-Newsletter anmelden. Weitere interessante Newsletter wie den Incrementum Research Newsletter können Sie hier abonnieren.

Erhalten Sie die den jährlich erscheinenden In Gold We Trust-Report sowie das Chartbook mit den dazugehörigen Charts.