“The ESG push and related green transformation effort have so much political capital behind them that failure is simply not an option. The best analogy to me is the euro.”

Steen Jakobsen

We start this year’s article where we left the In Gold We Trust report 2021: the road to the Paris Accord, -1.5oC by 2030.[1] We will be discussing COP26, the resulting paradigm shift to a low-emissions economy and its meaning for gold-producing companies. We will be introducing a new metric for gold producers: all-in emissions costs.

We will then look at gold’s competitive advantages over other asset classes with regards to CO2 emissions and how gold can balance a portfolio’s emissions footprint. Finally, we will focus on a recurring theme for the past 18 months: jurisdiction risk.

After a 12-month pandemic delay, the UN Climate Change Conference (COP26) was held in Glasgow in October 2021. This was the international stage on which the main ESG objectives for the next five years, if not decades, were defined. The summit concluded with the unanimous adoption of the Glasgow Pact, which aims to increase climate-control ambitions and actions by keeping the 1.5°C target alive, better defining the urgency of tackling global warming and, in doing so, reducing greenhouse gas emissions (GHG). This will require vigorously pursuing the 2050 path to net zero emissions with actions rather than mere promises.

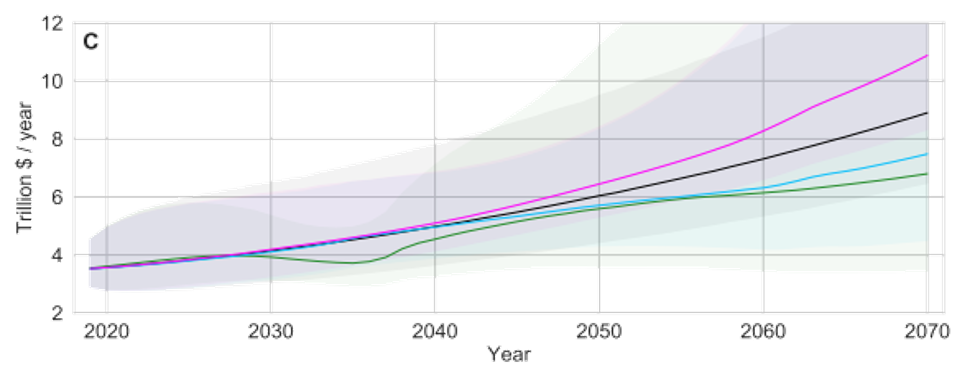

Source: Way, Rupert, Penny, Mealy and Farmer, Doyne J: “Estimating the costs of energy transitionscenarios using probabilistic forecasting methods,” INET Oxford Working Paper, No. 2021-01, p. 12

To achieve net zero, an unfathomable amount of capital will have to be continuously deployed for decades. Consequently, where will the funds come from?

You guessed it: Funds will flow from the central banks’ printing presses. As quantitative easing would gradually give way to quantitative tightening, central banks are on the lookout for new means to artificially boost the economy to avoid an economic meltdown and continue the endlessly ballooning growth. No government leader wants to be admitted to an austerity rehab program. In this vein, COP26 has provided the ideal escape route: saving the planet, one tonne of CO2 at a time, by focusing on energy transition and reducing CO2 emissions, whatever the cost. The new economy will avoid CO2 as much as possible.

Financing the energy transition will allow governments to undertake new debt-creation objectives:

To meet these objectives, money will have to flow differently than it has since QE was first implemented. Money will not go to bankers and a select few, as previously, but to consumers, contractors, project owners, and financiers who are assisting in the fight against climate change. As discussed in last year’s In Gold We Trust report,[2] we believe that gold miners should benefit from such new financings and should focus on financing the energy transition, with the main goal of maximizing emissions reduction.

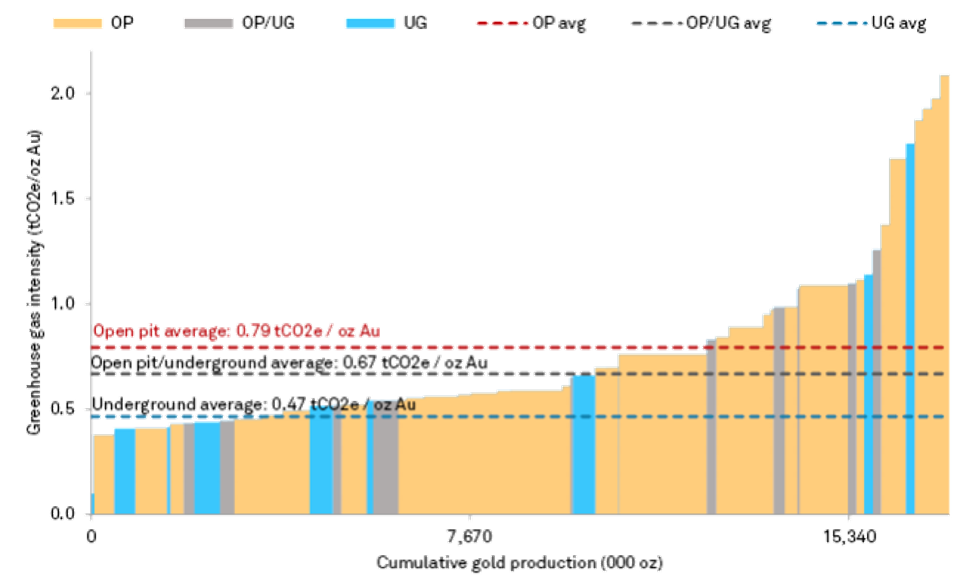

Gold mining companies emitted an average of nearly 1 tonne of CO2 per ounce of gold produced in 2019. However, strong differences exist both regionally and between open-pit versus underground mining methods. Underground mining operations have on average lower CO2 emissions than open-pit or hybrid mining, as seen in the following chart.

Source: S&P Global: “Greenhouse gas and gold mines – Emissions intensities unaffected by lockdowns”

The following case provides an interesting insight into emission-reduction possibilities, but also underlines that many other factors influence the emissions of a gold mine:

Comparing gold mining companies or future gold mines solely on emissions is extremely difficult, as emissions are reported as nonfinancial information. The incorporation of nonfinancial data into financial reporting is simply deficient. Investors must sift through sustainability reports for hours to determine the costs – both present and future – of Scope 1 and Scope 2 emissions. In the new low-emission economy, a new economic metric must be created for the mining sector: all-in emissions cost (AIEC). This metric will translate nonfinancial into financial, actionable costs for investors and stakeholders.

The AIEC is the total of all Scope 1 and Scope 2 emissions of a gold mining company, multiplied by the projected regional carbon credit price, divided by the amount of gold produced. Scope 1 emissions occur directly in the company, while Scope 2 emissions are indirect GHG emissions associated with the purchase of electricity, steam, heat, or cooling. (Scope 3 emissions are those that occur in the upstream and downstream supply chain. They are not included in AIEC.) For gold miners, we believe AIEC will be widely adopted throughout the industry in short order.

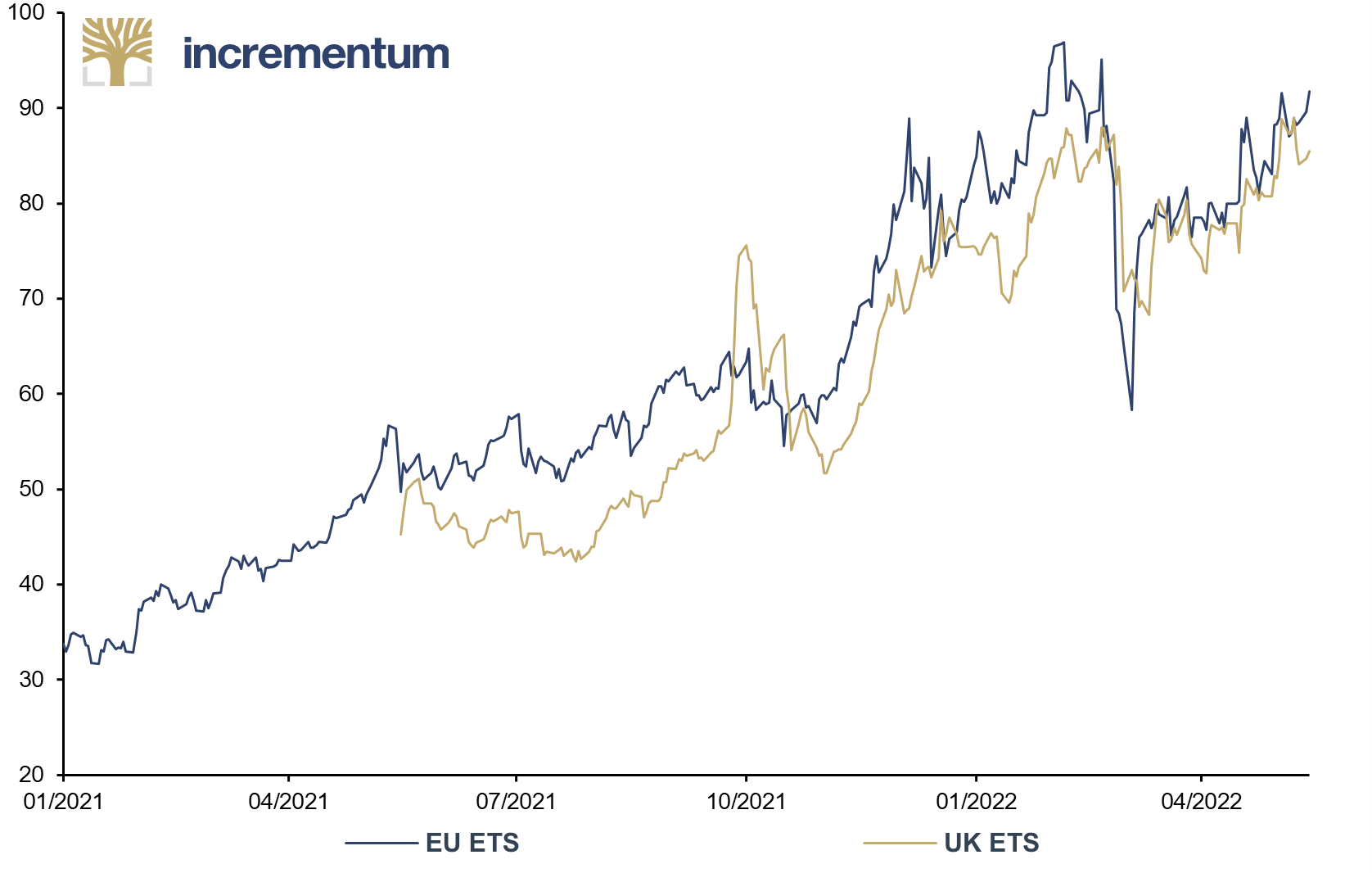

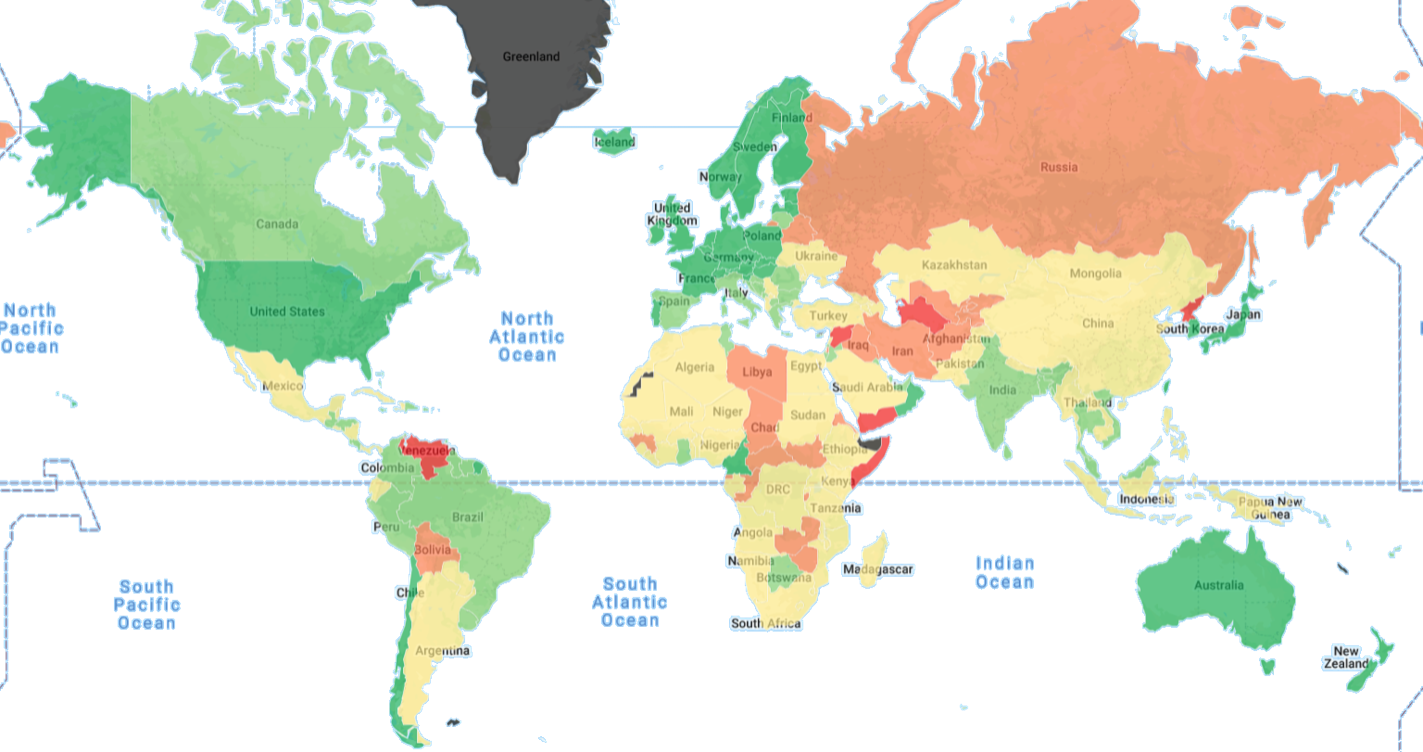

Source: ember-climate.org, Incrementum AG

As seen in the above chart, current carbon credit prices vary in different regions of the world and could accordingly lead to financial benefits and improved economics, depending on the jurisdiction. We believe AIEC should not be included in AISC, but rather be seen as a stand-alone metric. This will become one of the most important metrics for new gold mining project financing, as it indicates long-term capital exposure and allows investors to easily translate CO2 emissions into US dollars and incorporate the result into their financial models.

AIEC will also allow investors to understand their current exposure and move capital according to the actual costs of emissions rather than solely on the basis of generic ESG scores regarding emissions.

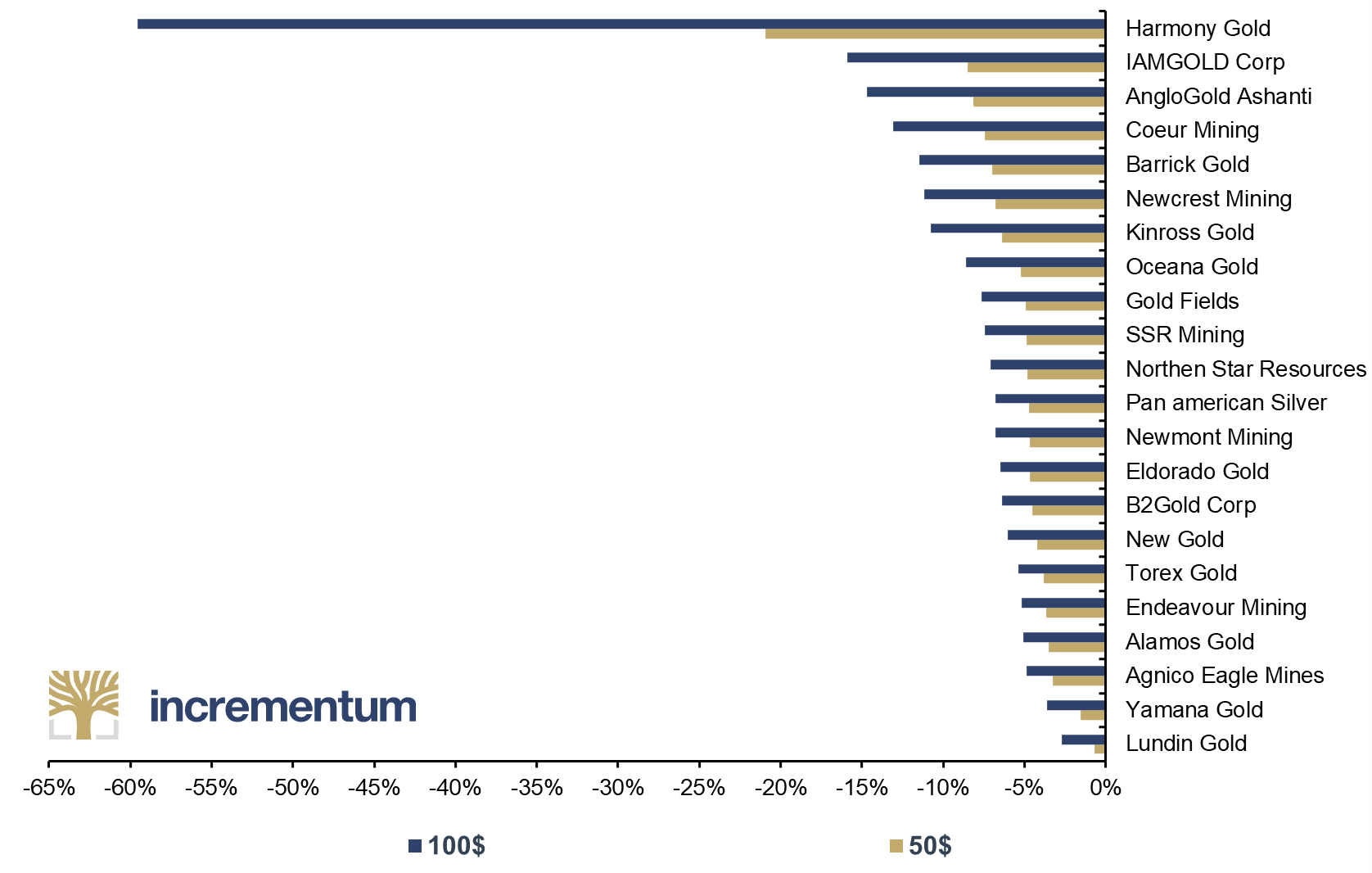

Source: Bloomberg, S&P, Reporting Companies, Incrementum AG

For most gold mining companies, the imposition of a carbon tax would have limited impact on their balance sheets. Additionally, for companies with high emissions, the tax would serve as an incentive to rapidly plan and execute their energy transition.

Gold has a significant advantage over other metals and, more broadly, most financial assets. When tracking a product’s CO2 exposure, most of the impact is frequently attributed to Scope 3. However, Scope 3 emissions from gold mining companies are almost nonexistent, because their product, gold bars, will undergo very little transformation, mostly through jewelry making and minting. Also, and counterintuitively, gold has extremely low Scope 1 and 2 CO2 emissions per ounce of gold produced for such large operations.

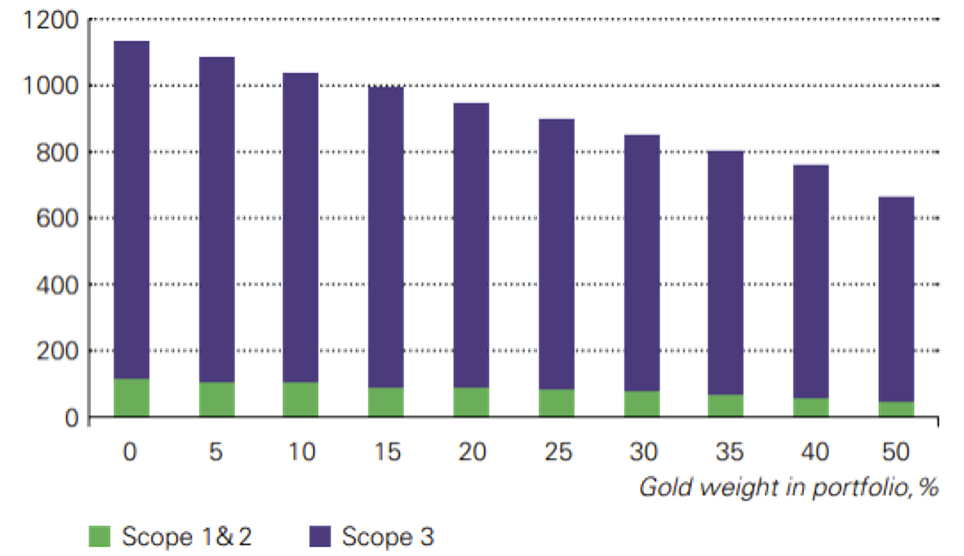

Consequently, increasing gold allocation in an investor’s portfolio results in a notable positive impact on the carbon footprint and emissions intensity of the overall portfolio.

Source: World Gold Council: “Gold and climate change – Decarbonising investment portfolios”, p. 2

For a portfolio of 70% equities and 30% bonds, introducing a 10% allocation to gold (and reducing other asset holdings by an equal amount) lowered the emissions intensity of a portfolio by 7%, and a 20% holding in gold lowered it by 17%, as calculated by the World Gold Council in a report titled “Gold and climate change – Decarbonising investment portfolios”.

Even more interesting, studies have shown that not only does gold allocation have a positive impact on portfolio CO2 emissions, it also maintains its advantage against the S&P 500 and even the carbon-efficient version of the S&P 500.

Depending on how emissions calculations evolve over time, physical gold could be the only truly neutral emissions asset, as physical gold has zero emissions because all emissions are produced when mining and refining the gold. Holding physical gold produces no emissions. This means that soon physical gold could improve the emissions impact of a portfolio even more, and increase its CO2 diversification.

Should investors now consider only emissions when investing in a gold mining company? Such thinking would be extremely reductive of all issues regarding ESG. Even if the consequences of the COP26 resolution adoption is to focus mainly on emissions, gold miners are facing increasingly difficult external factors, rendering investment decisions for all stakeholders, from producers to bankers or investors, increasingly more complex.

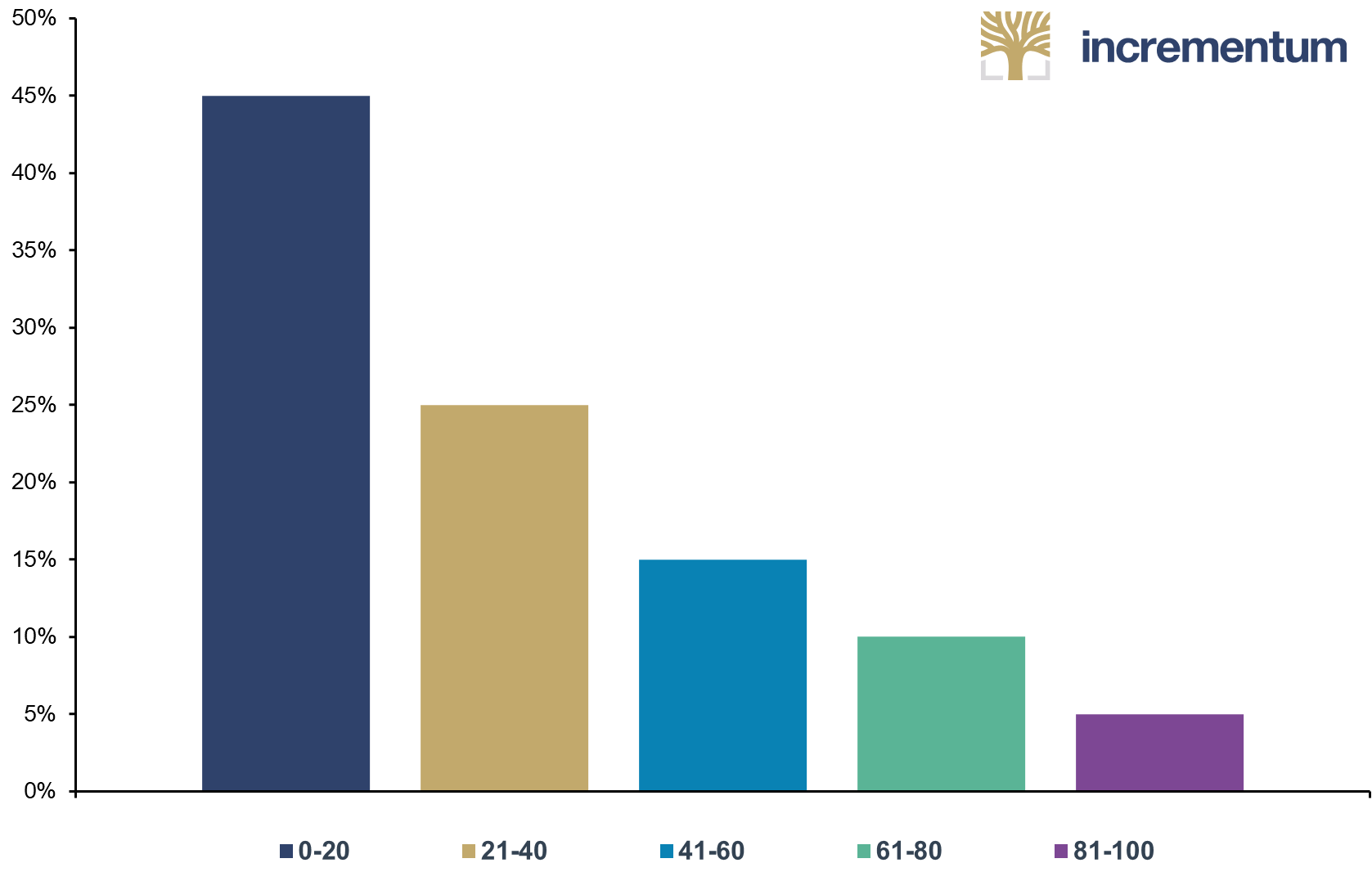

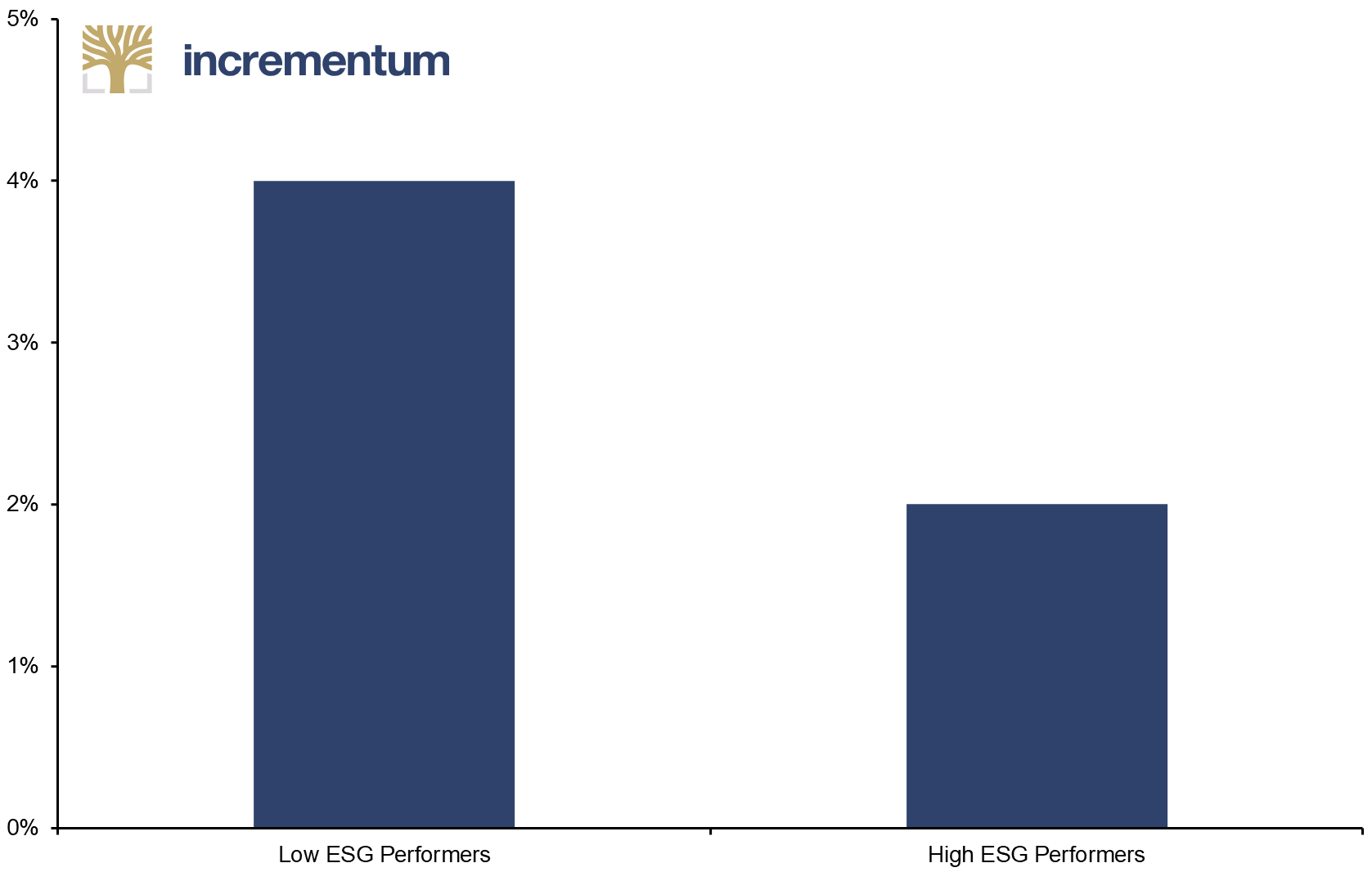

The correlation between ESG score and stock performance has been well documented and established.[3] Mining stocks with higher ESG ratings have outperformed the market and demonstrated greater resilience, a correlation that has persisted throughout the Covid-19 outbreak. However, as we are looking at the aspects of a low-carbon economy, how does ESG translate in terms of loan-default rates for bankers? Is there an incentive for both the creditor and the borrower to finance top-tier ESG-rated companies and projects at better rates and lending conditions? The answer is yes, as the percentage of commercial loan clients in default is directly proportional to the debtor’s ESG score.

Source: Bain & Company, Incrementum AG

Even more interestingly, when directly comparing companies a year after they started at the same risk rating, low ESG performers were roughly twice as likely as high ESG performers to fall behind on payments over the course of the year.

Source: Bain & Company, Incrementum AG

Investment committees will have to dig even deeper into their ESG analysis to increase the accuracy of their risk models and improve their client’s’ risk evaluation. This could translate into better financing terms and conditions and improve funding costs for top-tier ESG performers. Investors’ demand for sustainable assets currently outstrips supply, and a bank that can securitize and sell its ESG-intensive loans will be able to obtain cheaper funding from governments. This will result in better terms and conditions for their clientele.

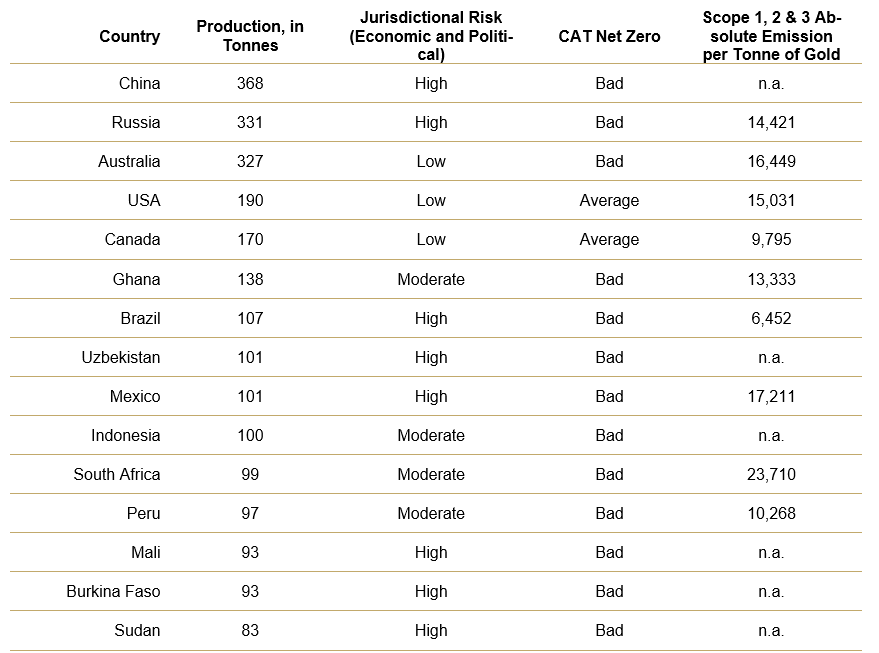

Jurisdiction risk, which has always been among the biggest risks in mining investment, has now risen to third place, and is still rising. There are currently over 50 gold-producing countries. Of these, only 15 countries account for almost 75% of current world production. None of these countries have clear targets on how to achieve net zero by 2050, and most of them present high political and economic risk.

Source: Climate Action Tracker, World Gold Council, Mining.com, Emission (tCO2e) per Ton of Gold, Incrementum AG

These countries’ gold mining companies have the best opportunities to move from planning to action and embrace the energy transition, both for self-produced and purchased energy. By committing to phase out fossil fuels as soon as possible, these companies will be seen as change agents in their communities, setting an example of responsible behavior and avoiding a massive increase in the price of carbon credits. As previously stated, the incentive is significant because current demand for financing such projects exceeds supply, putting downward pressure on financing costs.

Geopolitical paradigm shifts are underway, and the mining industry is at the center of many of them. Jurisdictional risks, more specifically political and economic risks, are now one of the top three concerns when a vetting committee examines a new investment.

Source: Marsh

As discussed previously, many gold mining companies have been impacted by political unrest and government interventionism in the past year, or are expected to be impacted in the near future:

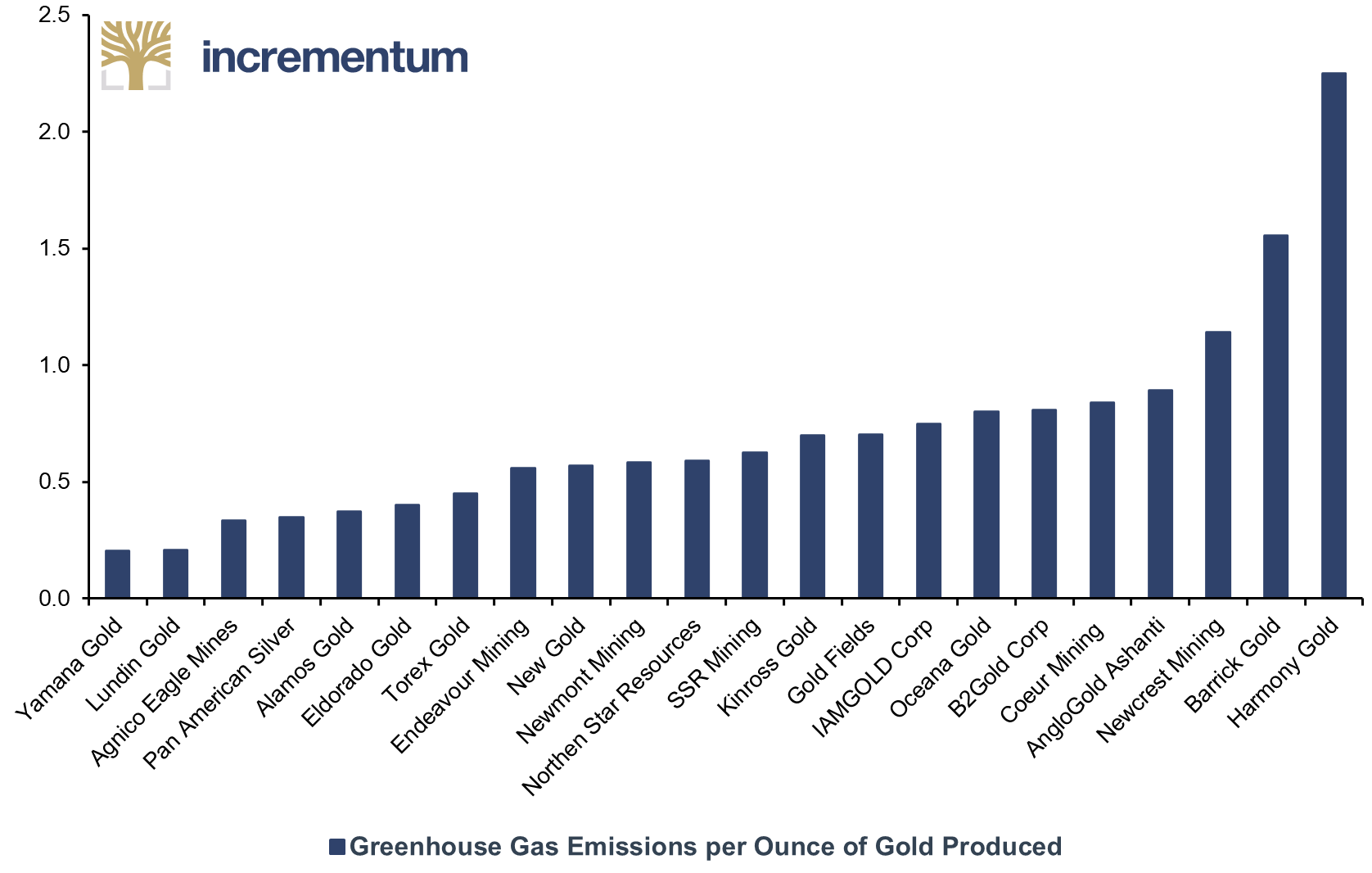

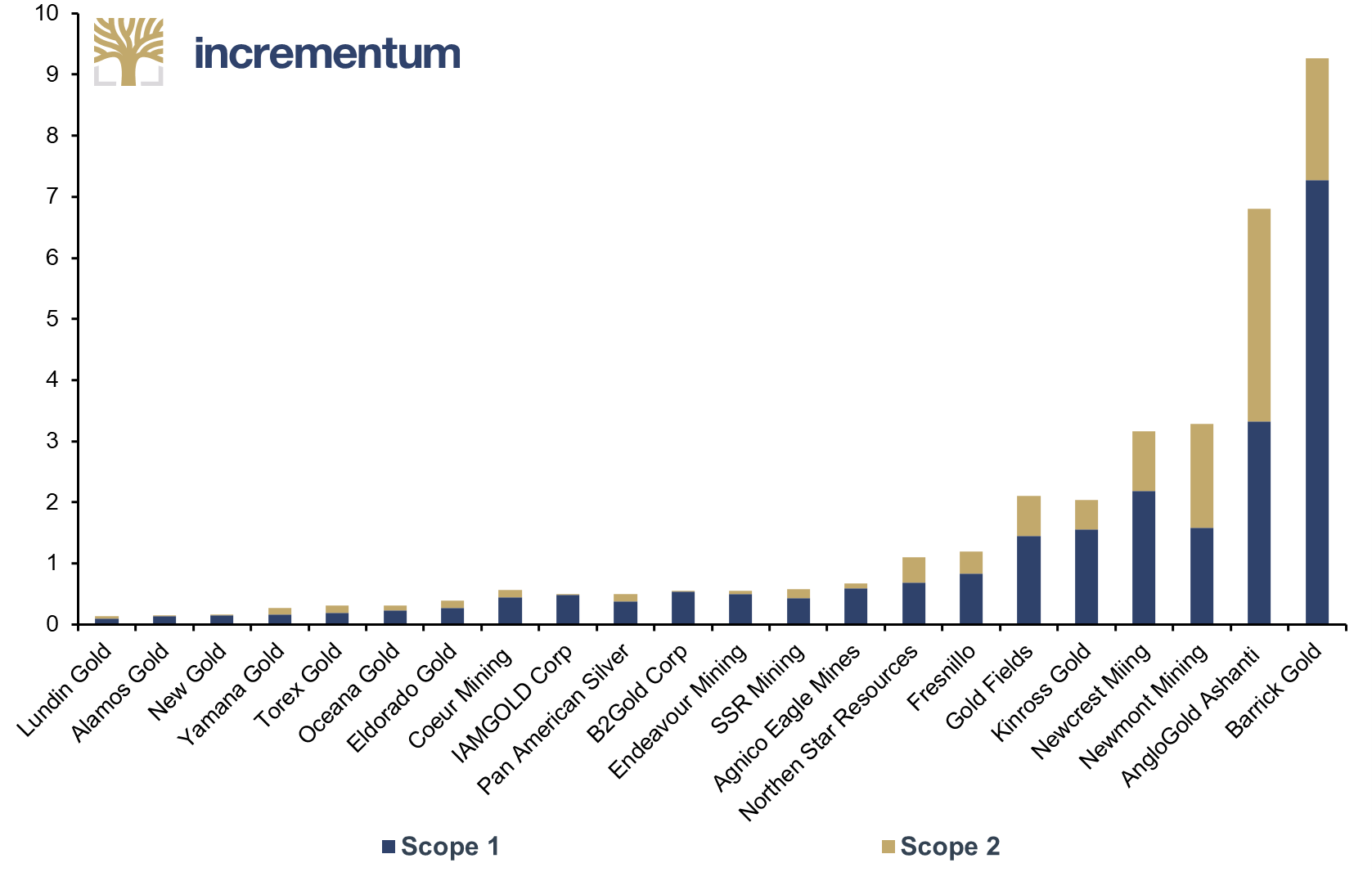

It is always difficult to establish best and worst in class based strictly on ESG scores. Diving deeper into ESG scores, we identified the best and worst performers per GHG emissions per ounce of gold produced, as well as per total Scope 1 and Scope 2 emissions.

Source: Bloomberg, S&P, Reporting Companies, Incrementum AG

There seems to be correlation between companies’ ESG scores and emissions, both per ounce of gold and per Scope 1 and Scope 2 emissions. As seen in the graph below, two companies, AngloGold Ashanti and Barrick Gold, are emitting massive amounts of CO2. These companies mostly use coal to produce electricity and should focus on rapidly transitioning to renewable energy.

Source: Bloomberg, S&P, Reporting Companies, Incrementum AG

How can investors know if the gold bar they bought came from one of the best or one of the worst ESG-performing gold producers? They must be able to assess where, how, and with which type of energy their gold was mined. Investors want to stay clear of any gold mined by criminal gangs or in conflict zones. To answer this growing need, the World Gold Council is developing, with the help of the London Bullion Market Association (LBMA) as well as aXedras and Peer Ledger, a digital system to track gold through the supply chain. Using blockchain technology, all transactions and movements will be tracked on a ledger.

This ledger will not be fully public in the way that Bitcoin’s is, but will be made available only to stakeholders. This initiative, with a focus firstly on simple traceability, will evolve into a fully transparent supply and custody chain for gold bars and coins.

The investment landscape comprises a spectrum of approaches, including a growing number of ESG factors. Strategies that use ESG as an additional consideration in the investment process, rather than relying on screening-based investment restrictions, are gaining in popularity. Events in the oil and gas sector in May 2020, when a Dutch court ruling accelerated Royal Dutch Shell’s goal to reduce carbon emissions from 20% to 45% by 2030, and on the same day Exxon Mobil Corp. was forced to accept two board members chosen by Engine No. 1, an activist hedge fund, perfectly demonstrate how ESG is not only here to stay but will shape corporate behavior from now on.

To assist this transition, the UN Principles for Responsible Investment (UNPRI) provides a highly practical framework. It lists six principles to help asset owners and managers structure an approach to ESG that is consistent with international peers, while remaining broad enough to avoid confining them to an unrealistic mandate. Since its inception in 2006, the UNPRI has gathered almost 4,000 signatories, with just over USD 120trn in assets under management as of 2020. Clearly, investors are no longer staying on the sidelines and waiting for the perfect solution, but are taking part in shaping tomorrow’s world in a more sustainable fashion.

Government intervention is on the rise all over the world. Given how difficult it is to assess the true outcome of COP26, the resulting paradigm shift to a low-emissions economy and mining nationalization, gold mining companies must commit to planning and implementing net-zero-by-2050 strategies. If not for the sake of saving the planet, they should do so in order to be able to access current favorable financing conditions.

To conclude, investors should prepare for the oncoming inflationary storm while avoiding the additional costs of the low-carbon economy. They should actively consider investing in gold miners with good ESG ratings and increase their gold allocation.

[1] See “ESG and Your Portfolio – Building a More Sustainable Future,” In Gold We Trust report 2021

[2] See “ESG and Your Portfolio – Building a More Sustainable Future,” In Gold We Trust report 2021

[3] See “ESG Compliance and Financial Stability,” In Gold We Trust report 2020

Erhalten Sie die den jährlich erscheinenden In Gold We Trust-Report sowie das Chartbook mit den dazugehörigen Charts, indem Sie sich für unseren In Gold We Trust-Newsletter anmelden. Weitere interessante Newsletter wie den Incrementum Research Newsletter können Sie hier abonnieren.

Erhalten Sie die den jährlich erscheinenden In Gold We Trust-Report sowie das Chartbook mit den dazugehörigen Charts.